Micro network news, recently the world famous semiconductor community semiwiki published the world core Electronics (Alchip) on ASIC technology research report.According to the report, ASIC was the foundation of the semiconductor industry until the IDM model flourished in the 1980s and 1990s.During this transition period, many semiconductor companies adopted ASIC production mode, which design and manufacture chips for other system companies such as IBM, NEC, Toshiba, and some specialized ASIC companies like VLSI Technology and LSI Logic, which also own their own fab.

Photo source: Network

Fabless has reversed the current situation, and the ASIC market is currently dominated by fabless-type companies.Today, the ASIC business is divided into two categories: ASIC-based fabless (GUC, Faraday, Core, Sondrel, Core, Alphawave, SemiFive, eInfochips, etc.) and other chip companies that are also designing ASIC (Broadcom, Marvell, Mediatek, etc.).Broadcom owns former Avago ASIC business; Marvell acquired ASIC business for eSilicon and Core / IBM; Mediatek develops its ASIC business.

Why is the surge in ASIC business?The reason is the same as why EDA, IP and TSMC thrive.All industries are developing their own ASIC.

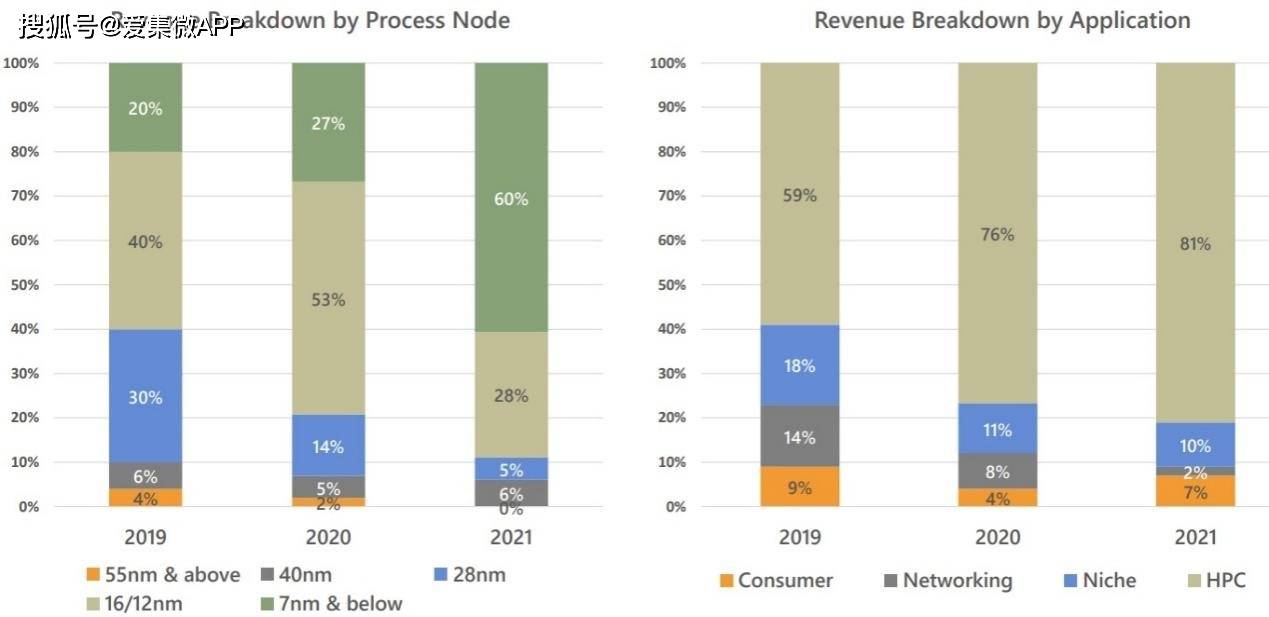

World Core (Alchip) released more convincing data, the company's revenue (88%) from 16nm to 5nm FinFET process design, including sophisticated advanced packaging technologies (CoWoS and MCM).

Figure source: Alchip

Johnny Shen, president and CEO of Alchip, expects strong demand for AI, high-performance computing and the Internet of Things in 2022.He also noted that a large number of advanced AI equipment will enter mass production in 2021.In short, the ASIC business is the oldest process in the semiconductor industry, and its development process has been very low-key.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr