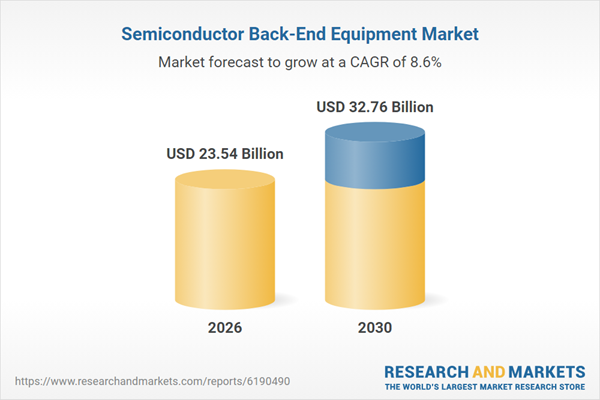

The semiconductor back-end equipment market has shown significant expansion, projected to grow from $21.65 billion in 2025 to $23.54 billion in 2026 at a CAGR of 8.7%. This growth is driven by increasing semiconductor demand, consumer electronics expansion, and advances in automotive and communication technologies. Market forecasts project a continued upward trajectory, reaching $32.76 billion by 2030, spurred by AI-driven testing and the rising demand for 5G electronics and smart devices.

Key market trends include the rise of advanced automation and high-precision testing systems, crucial for optimizing yield and quality control. The miniaturization of semiconductor devices and integrated assembly solutions also play a vital role in market expansion. A significant factor influencing growth is the focus on electric vehicles (EVs), which demand advanced power chips for better energy efficiency and battery performance. The EV market's growth, exemplified by an increase in plug-in electric vehicle sales from 6.8% in 2022 to 9.4% in 2023 in the US, supports the semiconductor back-end equipment market's expansion.

Leading companies such as BE Semiconductor Industries N.V. are innovating with technologies like hybrid bonding systems, providing superior electrical and thermal performance. In May 2024, BE Semiconductor Industries received a significant order for 26 Hybrid Bonding Systems, showcasing growing industry interest. This trend indicates a pivotal shift towards enhancing performance and efficiency in next-generation devices.

Meanwhile, market consolidation continues with Cohu Inc.'s acquisition of Equiptest Engineering in October 2023, aiming to broaden their test contactors and consumables portfolio. The acquisition reflects strategic moves to strengthen positions within the global market. Major companies within this sector include ASE Group, Applied Materials Inc., and KLA Corp., among others.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr