Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an increasing share of capacity to HBM production, shortages of conventional memory chips have begun to emerge, strengthening suppliers' bargaining power across the industry.

Executives, including Jensen Huang, Nvidia's chief executive, and Elon Musk of Tesla, have publicly voiced concerns over tightening memory supplies. As a result, Samsung and SK Hynix have swiftly risen to the status of what industry insiders describe as "super suppliers," wielding unprecedented influence in the semiconductor supply chain.

Memory shortages shift power to suppliers

According to reports from South Korean media outlets such as The Chosun Ilbo and Seoul Economic Daily, Samsung is preparing to conduct final quality validation of HBM4 ahead of planned mass shipments, tentatively scheduled for February 2026. But Nvidia is said to be pressing for shipments to begin regardless of the test results—an unusually relaxed stance compared with the stringent quality reviews that accompanied earlier generations like HBM3E.

Industry sources in South Korea say Nvidia has recently urged Samsung to begin supplying HBM4 even before completing full reliability and quality assessments. With both Samsung and SK Hynix already in the final stages of testing, Nvidia appears confident that the chips have reached an acceptable level of maturity and is seeking to bypass additional verification steps to accelerate delivery.

Speed contest intensifies among AI chip makers

Analysts note that as competitors such as AMD and Google race to gain ground in the artificial-intelligence chip market, Nvidia has effectively launched a speed contest over HBM4 supply. The shift underscores a dramatic reversal of roles: while South Korea's two memory giants are entering a period of extraordinary profitability, they are also emerging as indispensable power brokers in the global AI ecosystem.

The memory market itself is undergoing a profound transformation. Persistent shortages have left major technology companies scrambling. Jensen Huang has warned that by 2026, global demand for memory will far exceed supply, making procurement across the supply chain exceptionally difficult.

Elon Musk has issued similar cautions, arguing that companies unable to secure sufficient semiconductors risk running into a "chip wall." Intel's chief executive, Lip-Bu Tan, has gone further, suggesting that meaningful relief from memory shortages may not arrive until 2028 at the earliest.

HBM becomes decisive factor in AI race

For years, control of the AI ecosystem largely rested with Nvidia, which dominates GPU manufacturing, or with big technology firms that operate large-scale AI models. But as competition intensifies, that balance is shifting. Without the computing performance enabled by HBM, even the most advanced AI accelerators may struggle to function at scale.

Access to HBM, therefore, is becoming a decisive factor—one that will shape the timing of AI chip launches and the expansion of data centers worldwide. This dynamic has elevated Samsung and SK Hynix into pivotal roles within the global AI industry.

Counterpoint Research estimates that by 2026, SK Hynix will command 54% of the global HBM4 market, while Samsung will hold 28%, together accounting for more than 80% of total supply. Once, Nvidia's GPUs were the industry's strategic choke point. Increasingly, that leverage may extend into memory itself.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

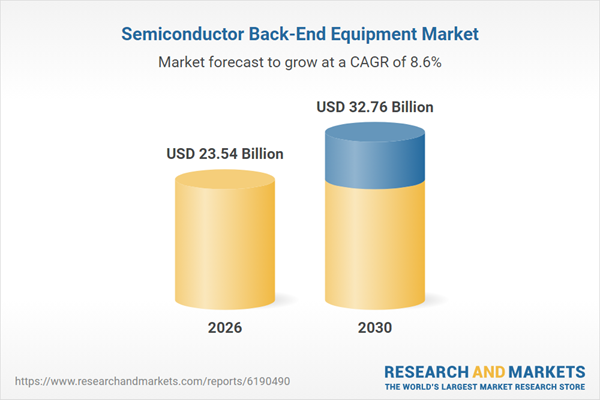

The semiconductor back-end equipment market has shown significant expansion, projected to grow from $21.65 billion in 2025 to $23.54 billion in 2026 at a CAGR of 8.7%. This growth is driven by increas