Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company will implement price adjustments for power switches and IC products starting April 1, 2026, and it is rumored that the maximum price adjustment reaches as high as 25%. Some Taiwanese companies plan to renegotiate prices for new orders after the Lunar New Year and in the second quarter of 2026.

Taiwanese power semiconductor suppliers, including Taiwan Semiconductor, Pan Jit International, Eris Tech, Advanced Power Electronics, and Excelliance MOS (EMC), are anticipated as likely to eventually implement across-the-board price increases, as copper prices have risen by nearly 40% and tin prices by nearly 60% over the past year, marking astonishing increases in raw material costs.

Lead times have also already doubled compared with 2025, meaning supply shortages are gradually spreading from isolated cases to regional ones, and could evolve into a widespread situation in the second quarter of 2026. Infineon's price hike notice also reflects that international major players have sufficient leverage to raise prices, and that non-international majors will follow suit in succession.

Some power semiconductor manufacturers say that after the Lunar New Year, new orders in the second quarter will be subject to renegotiation, and discussions with customers on pricing are already underway to gradually reflect manufacturing-side cost increases. Some Taiwanese manufacturers have recently seen strong order intake, with foundries needing to insert rush orders to meet urgent customer demand. However, due to rising raw material prices, executives are now having to personally chase materials, emphasizing the significant short-term cost pressure.

Smaller-scale Taiwanese manufacturers note that they still need to assess the actual extent of cost increases from packaging, testing, and foundry services, as premature price hikes would not be conducive to maintaining customer relationships. As soon as Infineon's price increase notice was released, power supply customers immediately called to inquire whether prices would be raised. Additionally, as Infineon shifts its focus toward higher-margin AI-related products, Taiwanese manufacturers are also hoping to gain transferred orders in the consumer and industrial control markets.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr

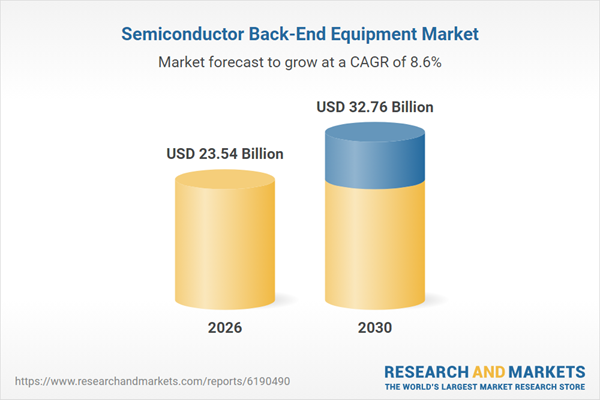

The semiconductor back-end equipment market has shown significant expansion, projected to grow from $21.65 billion in 2025 to $23.54 billion in 2026 at a CAGR of 8.7%. This growth is driven by increas