2026 is shaping up as a breakout year for cloud application-specific integrated circuit (ASIC) shipments. Not only has Broadcom secured mass production projects with multiple major cloud service providers (CSPs), but Taiwanese firms MediaTek, Alchip, and GUC also have new products entering mass production. These developments are expected to deliver solid revenue contributions despite ongoing market uncertainties.

Leading research institutions estimate that nearly 30% of AI server shipments in 2026 will feature ASIC-equipped racks. Based on actual demand from CSPs and AI companies, there appears to be little room left this year for further delays in ASIC volume ramp-up.

Industry insiders familiar with the ASIC sector note that after a recent period of restructuring, major CSPs have broadly confirmed plans to expand their ASIC procurement. This surge is driven by rapidly increasing computational demands for AI-related functions, which have now reached scale efficiencies. As a result, these companies recognize that integrating ASICs delivers significant overall cost benefits in computing.

Among them, Google's TPU demand remains robust, AWS maintains sizable projects, and Meta, though slightly behind schedule, is preparing to initiate new product mass production.

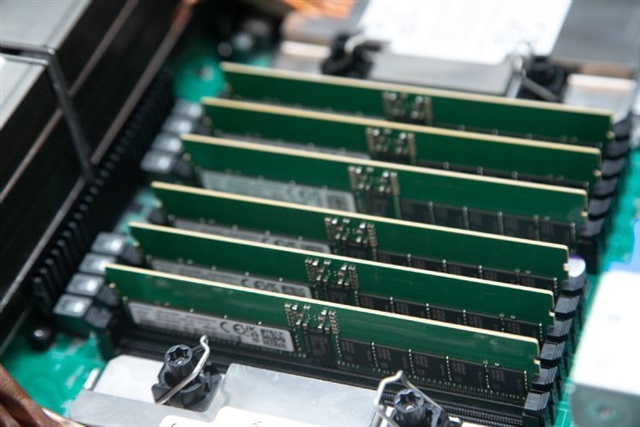

While demand-side factors no longer justify ASIC shipment delays, supply-side constraints—particularly advanced process technology and memory capacity—have emerged as less stable elements.

Although some larger CSPs have collaborated closely with ASIC partners to secure advanced process node capacity, unexpected shortages in memory supply have caught industry players off guard.

Reports indicate dissatisfaction among CSPs regarding the amount of memory allocated for 2026, posing a significant risk to the pace of ASIC new product volume production and deployment next year.

However, most ASIC vendors stress that even if customers face memory supply limitations in 2026, they have reportedly signed protective long-term contracts securing memory availability for 2027 and 2028. In other words, any shortfall in production this year should be compensated for next year. Given the current strong momentum in the AI market, project demand is expected to grow rather than decline.

ASIC suppliers also highlight that the critical focus now is to continue winning development collaborations for subsequent generations of products. Ensuring steady ASIC business through 2029 and 2030 will remain vital for sustaining company operations.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

hina's National Development and Reform Commission (NDRC) has issued a rare monitoring report warning that rising memory prices are spreading across the electronics supply chain as tight supply and

Nvidia strengthened its dominance in the add-in-board (AIB) GPU market in the fourth quarter of 2025, capturing a record 94% market share even as overall shipments dipped amid rising memory prices and

Broadcom shares rose sharply in aftermarket trade on Wednesday after the artificial intelligence chips maker delivered a quarterly top and bottom-line beat and provided current quarter revenue guidanc