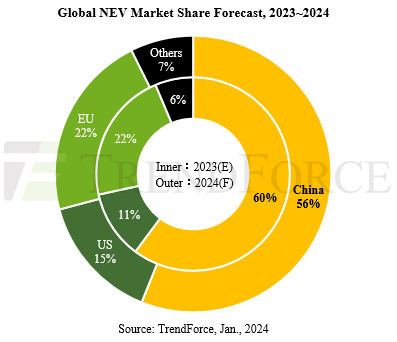

TrendForce reports that the global sales volume of NEVs (including BEVs, PHEVs, and FCVs) is estimated to reach approximately 12.8 million units in 2023. Regional market sales shares are expected to be 60% in China, 22% in Western Europe, 11% in the United States, and 6% in other regions, with China’s market demand distinctly in the lead. However, with China’s subsidies gradually phasing out and the increasing market penetration of NEVs in the country, the growth rate of China’s NEV market is starting to slow. This, coupled with the growing demand for electric vehicles in overseas markets, is prompting numerous Chinese automotive brands to expand internationally, particularly in Southeast Asia, where they are projected to hold a 67.5% market share in 2023.

Benefiting from early government and industry initiatives and supported by a large domestic market, China’s EV industry has developed a complete supply chain and cost advantages due to rapid technological evolution driven by intense competition. TrendForce forecasts that China will export about 4.8 million automobiles in 2023, with NEVs making up approximately 25% of these exports. The rising export volumes have caught the attention of governments worldwide, especially since many major manufacturers, not just Chinese brands, have factories in China. Exporting vehicles from China to other markets could reduce local production volumes and values of complete vehicles and components, further impacting employment rates and economic performance.

TrendForce notes that the automotive industry is currently facing high raw material and labor costs, as well as significant investments in electrification and autonomous driving. Balancing the protection of local enterprises, maintaining competitiveness, and managing consumer costs is an urgent task for governments worldwide. Most countries are focusing on the country of origin rather than the brand of vehicles in their restrictive measures. For example, the United States imposes a 25% tariff on vehicle imports from China and is discussing further increases.

Measures taken by the US—specifically for EVs—include requiring that EVs and their batteries be assembled in North America. Furthermore, critical minerals in the batteries must originate from countries that have signed free trade agreements with the US to qualify for subsidies totaling US$7,500. As such, the Chinese supply chain is excluded. The EU has initiated an anti-subsidy investigation against Chinese-made EVs, and France’s new subsidy regime for EVs requires compliance with carbon emission standards during manufacturing, effectively excluding many EVs imported from China.

Overall, under the restrictive measures imposed by various governments, international manufacturers need to assess tariffs, subsidies, and production costs before deciding on their production locations. TrendForce suggests that for Chinese automakers seeking to expand overseas, the high cost of exporting vehicles from existing factories in China could diminish their price competitiveness. Despite this, countries like Italy, Hungary, Thailand, and Indonesia maintain a positive stand toward Chinese automakers setting up local factories—given their significant advantages in the EV market.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr