Q3 PC shipments were 7.2% down y-o-y at 68.5 million units in the third quarter of 2023, according to IDC, which expects full-year 2023 shipments to be down 13.8% y-o-y which was itself a 16.6% down year on 2021.

Two consecutive years of double-digit year-over-year drops is unprecedented in the PC market.

IDC’s hopes for a market rebound in 2024 rest on:

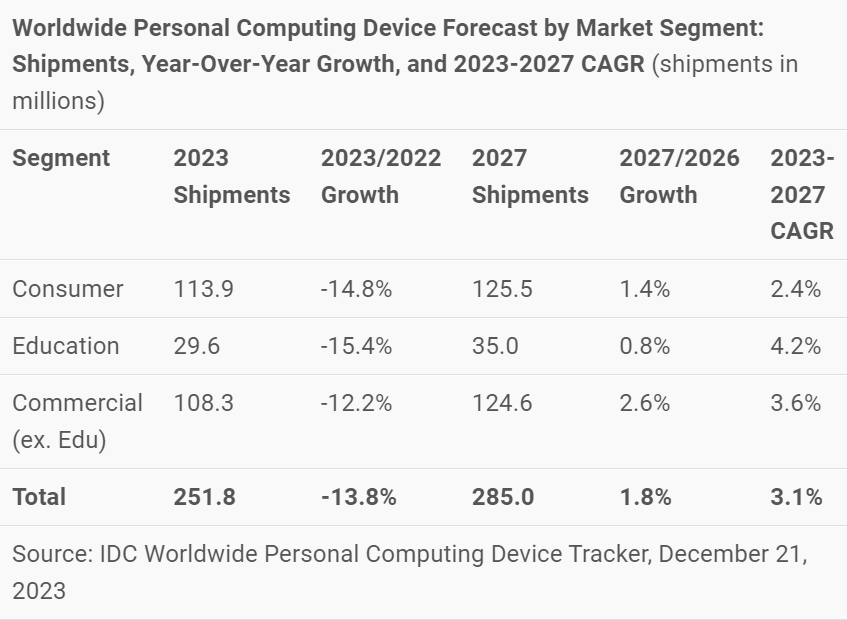

PC Refresh Cycle: The vast and aging installed base of commercial PCs surpassing the four-year mark by 2024 is expected to necessitate a refresh, coinciding with the pressing demand to migrate toward Windows 11. The total PC market of 2024 should see growth of 3.4% compared to 2023.AI Integration: The integration of AI capabilities into PCs is expected to serve as a catalyst for upgrades, hitting shelves in 2024 and at first aimed toward certain segments of the enterprise PC market. Over time, further advancement in use cases and cost reductions could spread to the broader market.Continued evolution and recovery of the consumer installed base.Beyond 2024, growth is expected to surpass pre-pandemic shipment levels and culminate in 285 million units by 2027.

“Perhaps historical context can offer some consolation to the tough slog the PC ecosystem is going through,” says IDC’sc Jay Chou, “while we still expect eight consecutive quarters of year-over-year volume declines from Q1 2022 through Q4 2023, it still pales to the 19 consecutive quarters of year-over-year PC declines from Q2 2012 to Q4 2016. Furthermore, notebooks are already at higher levels than 2019, signaling a sizable expansion of the notebook market even after COVID-induced purchases have subsided. We maintain that factors like hybrid work, commercial refresh, and growth in premium PCs can lead to a compound annual growth rate of 3.1% from 2023 through 2027.”

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr