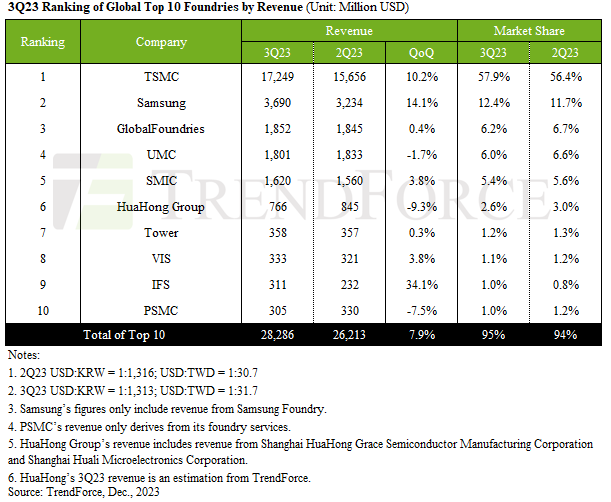

The top ten foundries grew revenues 7.9% to $28.29 billion, and Q4 revenues could grow faster, reports TrendForce.

TSMC, with 58% market share, grew Q3 revenue by 10.2%—reaching $17.25 billion. The 3nm process alone contributed 6% to TSMC’s Q3 revenue, with advanced processes (≤7nm) accounting for nearly 60% of its total revenue.

Samsung grew foundry revenue by 14.1% to $3.69 billion in Q3, driven by orders for Qualcomm’s mid-to-low range 5G AP SoC, 5G modems, and mature 28 nm OLED DDI processes.

GlobalFoundries maintained a stable performance in Q3, with its revenue approximating $1.85 billion, similar to the previous quarter.

UMC’s Q3 revenue declined 1.7% to $1.8 billion. Revenue from its 28/22 nm products saw a near 10% increase, representing 32% of UMC’s total revenue.

SMIC had a 3.8% Q3 revenue increase to $1.62 billion. However, the revenue share from American clients decreased to 12.9%. Conversely, revenue from Chinese clients increased to 84% due to the government’s localisation initiatives and urgent orders for smartphone components.

Notable changes in the rankings from sixth to tenth position include VIS and IFS, with the latter entering the global top ten for the first time since Intel’s financial restructuring.

VIS’ Q3 revenue increased by 3.8% to $333 million—surpassing PSMC to take the eighth position.

IFS had a 34.1% increase in revenue to approximately $311 million.

HuaHong saw a 9.3% decrease in Q3 revenue to about $766 million.

HHGrace maintained steady wafer shipment levels from the previous quarter, but a roughly 10% decrease in ASP led to a decline in revenue.

Tower Semiconductor saw stable demand in the smartphone, automotive, and industrial sectors, maintaining revenue at around $358 million in Q3.

PSMC witnessed a 7.5% drop in revenue to $305 million, with PMIC and Power Discrete revenues declining nearly 10% and 20%, respectively, impacting overall performance.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr