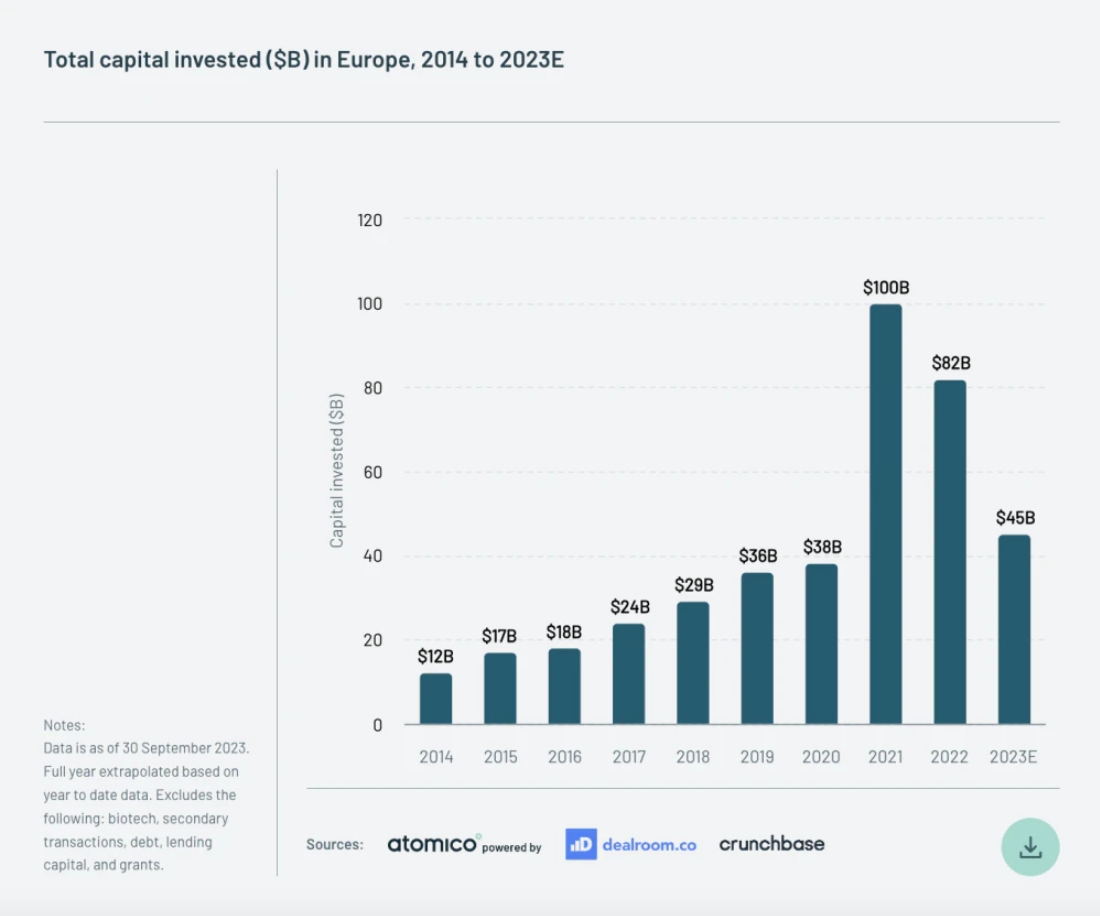

Tech investment in Europe will amount to about $45 billion this year compared to $82 billion last year, says a report from Atomico.

Worst hit will be companies at the growth stage requiring late-stage capital injections to scale up.

But Europe is the only region where investment has risen from 2020 levels – by 18% – whereas the US expected figure of $120 billion is a 1% drop from 2020 and the figures for China and RoW are expected to drop by 7% and 8%, respectively.

Investment in European late-stage tech startups has almost dried up as the IPO market makes exits unappealing.

Looking at funds which invest in both public and private companies – so-called cross-over funds – Atomico found only four such investments this year compared with 82 in 2021.

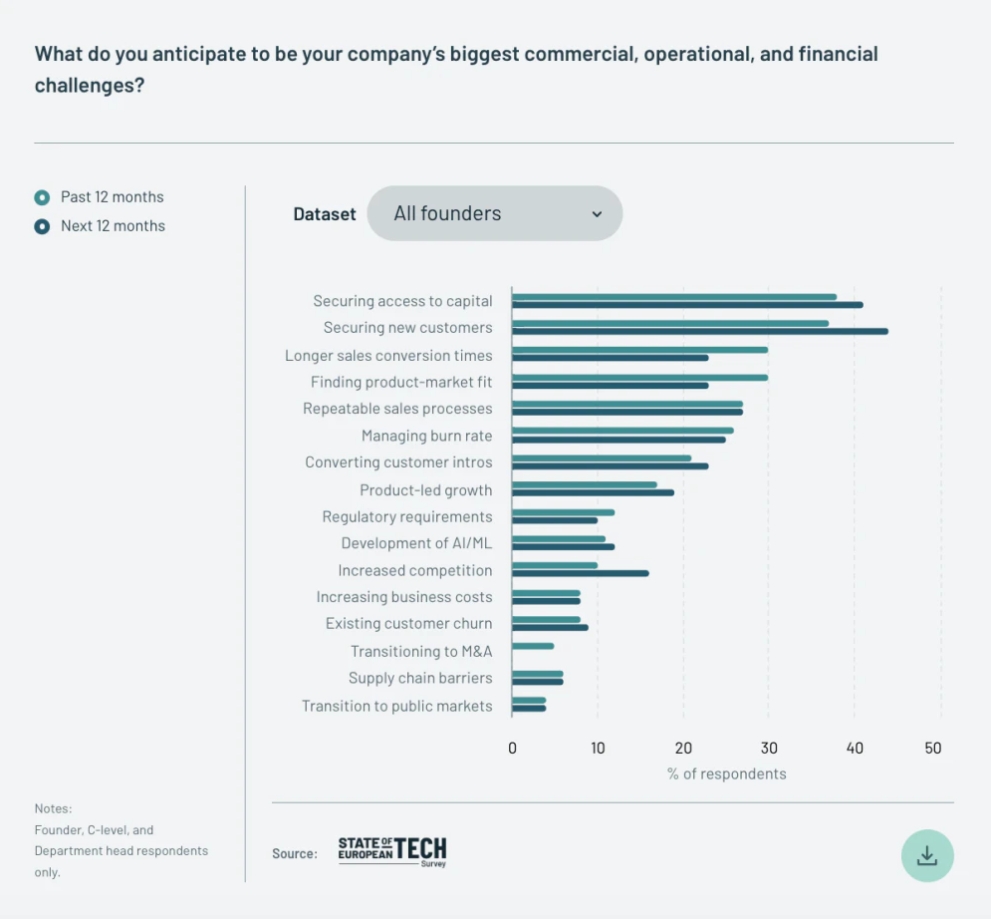

Over the past 12 months, raising capital was the most frequently cited challenge by founders and senior startup leaders, with 38% saying it was their biggest challenge. Securing customers was next on the list of anxieties, with 37% saying it was their biggest challenge.

Founders aren’t particularly bullish for 2024 — 41% said raising capital would be one of their biggest challenges and 44% said securing customers would be

While the rate that founders are starting new companies has fallen 30% since its peak in 2020, there are more new first-time founders in Europe than there are in the US.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr