“There is evidence that the PC market’s decline has finally bottomed out,” says Gartner’s Mikako Kitagawa, “seasonal demand from the education market boosted shipments in the third quarter, although enterprise PC demand remained weak, offsetting some growth. Vendors also made consistent progress towards reducing PC inventory, with inventory expected to return to normal by the end of 2023, as long as holiday sales do not collapse.”

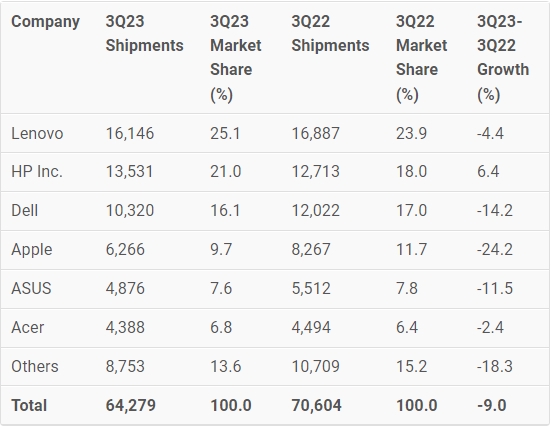

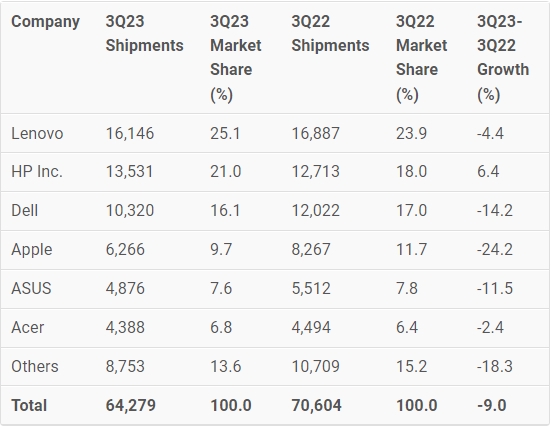

The top vendors in the worldwide PC market remained unchanged in the third quarter of 2023, with Lenovo maintaining the No. 1 spot in shipments with 25.1% market share (see Table 1).

Table 1. Preliminary Worldwide PC Vendor Unit Shipment Estimates for 3Q23 (Thousands of Units)

Notes: Data includes desktop and laptop PCs that are equipped with Windows, macOS or Chrome OS.

Source: Gartner (October 2023)

While Lenovo once again saw a year-over-year decline in shipments, it was eased to a single digit decrease. Meanwhile, HP was the only vendor to exhibit year-over-year growth, with shipments increasing across all regions. Dell reported a sixth consecutive quarter of shipment decline, impacted by weak enterprise PC demand given its a strong presence in the market.

Apple’s shipments declined sharply compared to a year ago, in part because its shipment volume increased significantly in 3Q22 once supply disruptions from earlier in 2022 due to China’s lockdown had eased. In the third quarter of 2023, Apple’s shipments followed seasonal trends, primarily driven by demand from students and educators.

“The good news for PC vendors is that that the worst could be over by the end of 2023,” said Kitagawa. “The business PC market is ready for the next replacement cycle, driven by the Windows 11 upgrades. Consumer PC demand should also begin to recover as PCs purchased during the pandemic are entering the early stages of a refresh cycle.”

Gartner is projecting 4.9% growth for the worldwide PC market for 2024, with growth expected in both the business and consumer segments.

Regional Overview

The U.S. PC market declined 9.3% in the third quarter of 2023 (see Table 2).

Table 2. Preliminary U.S. PC Vendor Unit Shipment Estimates for 3Q23 (Thousands of Units)

Source: Gartner (October 2023)

The U.S market’s decline was primarily caused by weak enterprise PC demand. However, Chromebook growth driven by replacement demand in K-12 educational institutions offset some of the decline.

The EMEA PC market declined 3.6% year-over-year. Continued political unrest, inflationary pressures and interest rate increases culminated in a new low in demand for PCs, although this quarter’s decrease was less severe than the previous two quarters.

“Organizations in EMEA are continuing to realign to the disruptive business outlook, limiting business PC spending as companies reduce PC budgets as a cost management strategy,” said Kitagawa. “Meanwhile, consumer demand in EMEA remains low, as all income brackets are affected by inflationary pressures and interest rates.”

The Asia Pacific PC market declined 13% year-over-year, driven by a steep 20% decline in China. In China, consumer PC spending remained weak due to unemployment issues, while enterprise PC demand also slowed due to spending cuts in the government.

In India, the Directorate General of Foreign Trade (DGFT) announced new restrictions on the import of certain devices in August 2023 as part of a bid to encourage local manufacturing. While the initial announcement caused a minor disruption as several vendors had to halt imports, a revised announcement soon after extended the deadline to November 2023 and imports resumed to normal volumes. The decision to implement any restrictions has now been moved to October 2024, meaning that the India PC market will see minimal impacts through the rest of this year.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr