“Geopolitical shifts are fundamentally changing the semiconductor game,” says IDC’s Helen Chiang, “while immediate impacts might be subtle, long-term strategies are focusing more on supply chain self-reliance, security, and control. The industry operation will move from global collaborations to multi-regional competitions,”

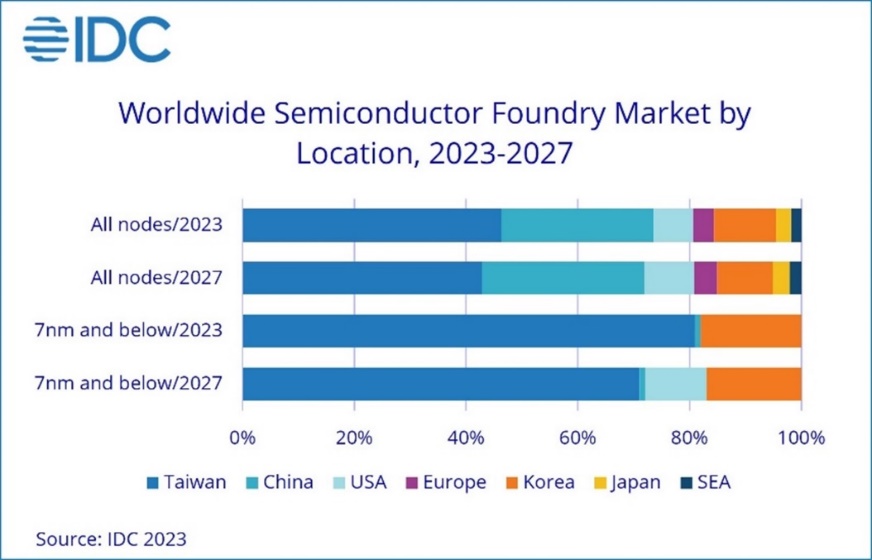

China’s rapid development of mature processes means its proportion of the foundry market will continue to increase, reaching 29% in 2027, an increase of 2% from 2023.

Taiwan’s proportion of the foundry market will fall from 46% in 2023 to 43% in 2027.

The US will make gains in advanced processes, and its share of the foundry market for 7nm and below is expected to reach 11% in 2027.

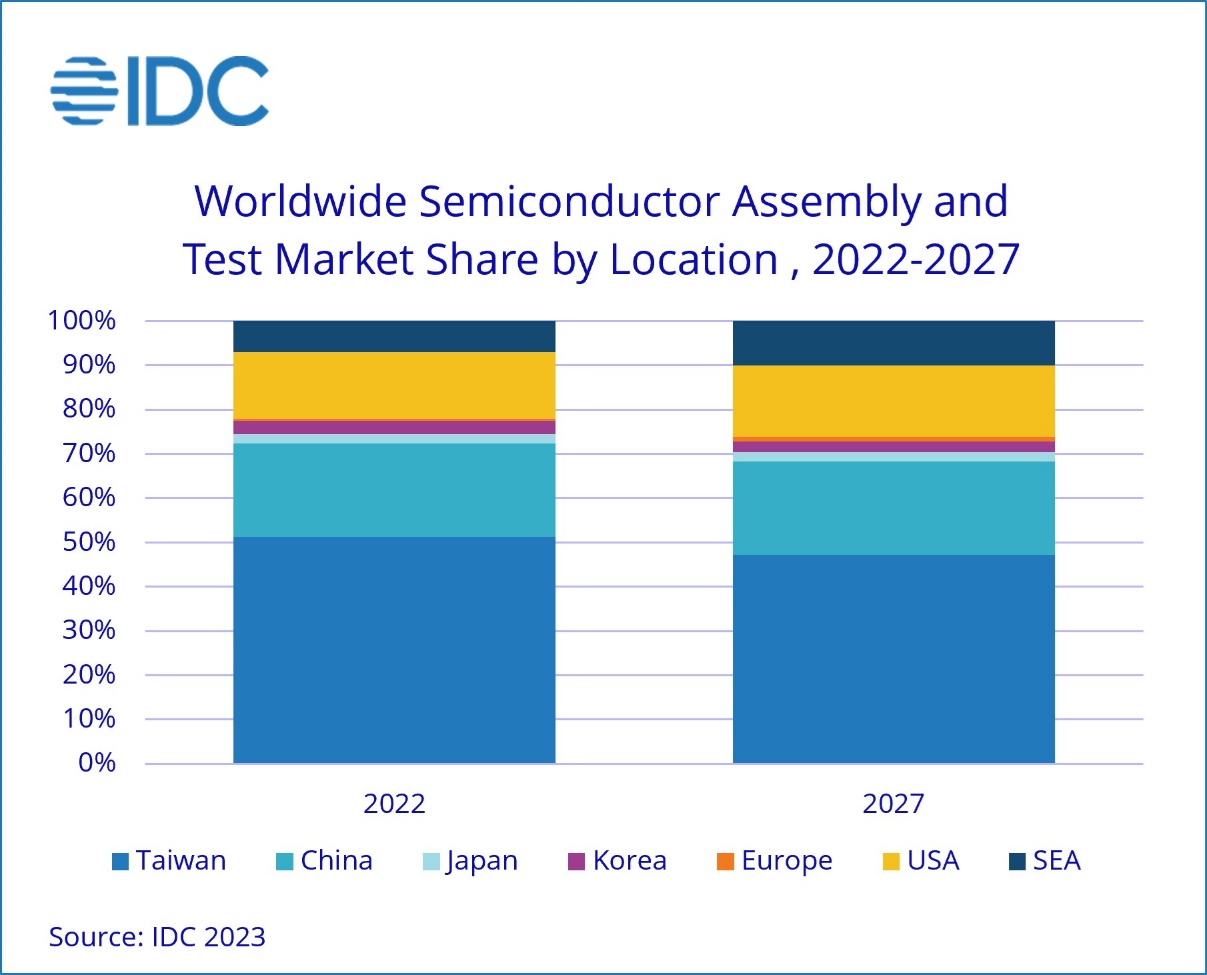

For assembly and test, IDMs have begun to invest more in the Southeast Asia market, and OSAT companies have begun to shift operations from China to Southeast Asia.

Southeast Asia is projected to play an increasingly important role in the semiconductor assembly and test market, especially in Malaysia and Vietnam.

Southeast Asia’s share of the global semiconductor assembly and test will reach 10% in 2027, while Taiwan’s share will decline to 47% in the same year from 51% in 2022.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr