Micron was the only supplier to increase shipments. The Big Three all had ASP declines.

Q2 should see a rise in shipments, predicts TrendForce, but further declines in ASP won’t increase revenues.

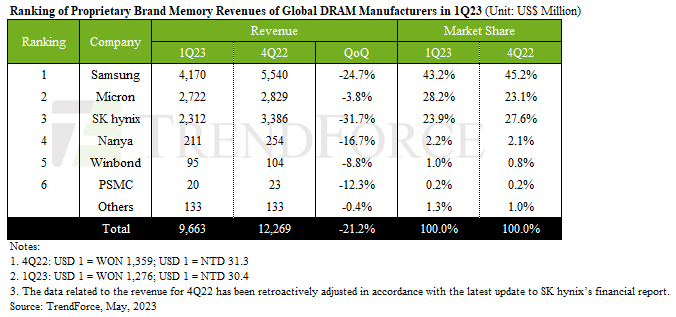

The Big Three all reported a drop in quarterly revenue. Samsung saw a decline in both shipment volumes and ASP, resulting in a QoQ decrease in revenue of 24.7%, amounting to about $4.17 billion.

Micron climbed to the second position in Q1 but suffered a 3.8% revenue decline, taking its total down to $2.72 billion.

Hynix had a 15% drop in both units and ASP, leading to a 31.7% plunge in revenue, amounting to approximately $2.31 billion.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr