JASPER, Ind. — Kimball Electronics, Inc. (Nasdaq: KE) announced financial results for the third quarter ended March 31, 2023.

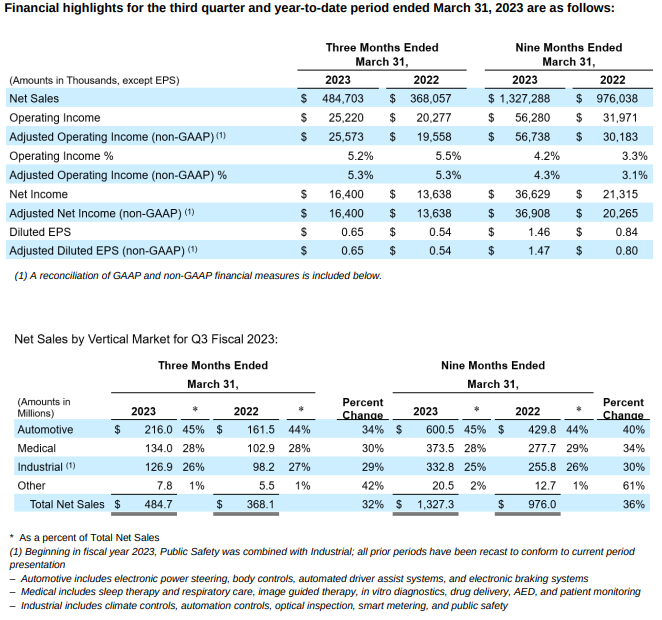

·Net sales in the third quarter of fiscal 2023 totaled $484.7 million, an all-time quarterly high and up 32% year-over-year; foreign currency had a 2% unfavorable impact on net sales compared to the third quarter of fiscal 2022.

·Operating income of $25.2 million, or 5.2% of net sales, compared to $20.3 million, or 5.5% of net sales, in the same period last year

·Adjusted operating income of $25.6 million, or 5.3% of net sales, compared to $19.6 million, or 5.3% of net sales, in the same period last year

Net income of $16.4 million, or $0.65 per diluted share, compared to net income of $13.6 million, or $0.54 per diluted share, in the third quarter of fiscal 2022“I am very pleased with my first quarter as CEO of Kimball Electronics, and the opportunity to share strong results for Q3,” said Richard D. Phillips Chief Executive Officer. “The Company has been on a path of unprecedented growth, and for the fifth consecutive quarter, revenue reached an all-time record high. Throughout this journey, operating margin has improved as we ramp-up new and existing programs, and leverage our recent facility expansions in Thailand and Mexico. While the macro environment remains challenging, we are forecasting a solid finish in the fourth quarter, and we are updating our outlook for fiscal year 2023, with sales expected at the high-end and adjusted operating margin in the mid-to-low end of our guidance range. We also have been updating our Strategic Plan, which includes review of the positioning, and growth opportunities, within the vertical markets we support. The learnings from this review are encouraging and the path to $2 billion in annual revenue is within our sights. After a fast-paced onboarding, I’m even more excited about our future.”

Source: EMS Now

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr