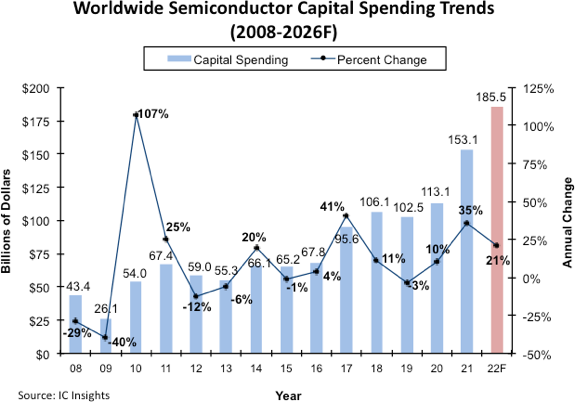

According to the latest data released by IC Insights, a leading semiconductor analyst firm, shows that the three years from 2020-2022 will be the first three-year period since 1993-1995 when capital expenditures achieved double-digit growth.

IC Insights adjusted its 2022 global semiconductor capital expenditure forecast, which now shows a 21 percent increase this year to $185.5 billion, as follows:

This is a decrease from the $190.4 billion and 24% growth forecast earlier this year. Despite the downward revision, the revised capex forecast still represents a new high level of spending.

Utilization rates remain well above 90% for many IDM plants and 100% for many pure-play foundries in the first half of the year, as the economic recovery during the epidemic kept orders strong.

Semiconductor capital spending is now expected to reach $338.6 billion for the two years combined in 2021 and 2022. IDMs and foundries are investing heavily in expansions for the manufacture of logic and storage devices using leading-edge process technologies. However, strong demand and continued shortages of many other important chips, such as power semiconductors, analog ICs and various MCUs, have led suppliers to increase manufacturing capacity for these products as well.

Despite all of this positive news, soaring inflation and a rapidly slowing global economy caused semiconductor manufacturers to reassess their aggressive expansion plans mid-year. Several (but not all) suppliers, particularly many of the leading DRAM and flash memory manufacturers, have already announced cuts to their capital expenditure budgets for the year. More suppliers are noting that they expect to cut capex in 2023 if they assess capacity needs based on the industry absorbing three years of strong spending and slowing economic growth.

source:aijiwei

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr