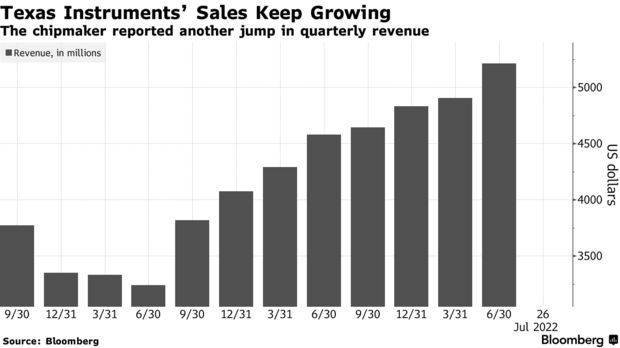

According to the report on July 26, Chipmaker Texas Instruments Inc on Tuesday announced its 22Q2 revenue increased by 14% year-on-year, 6.3% quarter-on-quarter, to $5.212 billion, better than the expectation of $4.65 billion. Meanwhile, its revenue grew by double-digit percent year-over-year for six consecutive quarters.

The gross profit for Q2 was $3.625 billion, up 18% year-over-year; operating profit was $2.723 billion, up 23% year-over-year; net income was $2.291 billion, up 19% year-over-year; and diluted earnings per share were $2.45, better than the expectations of $2.12, compared to $2.05 in the same period last year.

Analog revenue grew 15% to $3.992 billion, Embedded Processing grew 5% to $821 million, and other segments grew 19% from the year-ago quarter to $399 million.

Dave Pahl, director of DEI Investor Relations of Texas Instruments, pointed out that the industrial market was up high-single digits, and the automotive market was up more than 20%. Weakness could be seen throughout the quarter in personal electronics, which grew low-single digits. Next, communications equipment was up about 25%. Finally, enterprise systems were up mid-teens.

Rafael Lizardi, treasurer of Texas Instruments, said in the teleconference the inventory days in Q2 were 125, down two days sequentially and below desired levels.

Texas Instruments CEO Rich Templeton said Q3 revenue is estimated to range from $4.90 billion to $5.30 billion (median $5.10 billion). EPS is estimated to range from $2.23 to $2.51 (median $2.37).

Lizardi added that Q3 financial expectation has considered the weak demand, especially in the personal electronics market.

According to the analysis on Yahoo Finance, the Q3 revenue of Texas Instruments is estimated to be $4.97 billion, and EPS is expected to be $2.26.

Source from Xinzhixun

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr