Although the demand for consumer electronics is decreasing, the supply of automotive MCUs is expected to stay tight until 2023, according to industry sources.

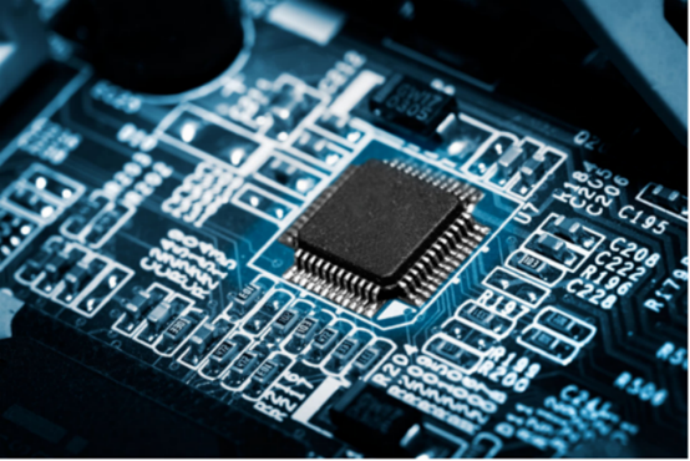

According to Digitimes, the electrification of vehicles is driving the use of electronics in vehicles. Demand for key automotive microcontroller units (MCU) continues to be hot. Taiwan-based semiconductor manufacturers estimate a single vehicle needs 20-30 MCUs. In the future, luxury vehicle models may need up to 100 MCUs, which is higher than the previously estimated 70 units.

With respect to the automotive MCUs, the manufacturers based in Chinese mainland constantly achieve great breakthroughs. For example, GigaDevice Semiconductor said that its sample of the 40-nm automotive MCU had been sent to the customers. SinoWealth estimated that its newly-developed automotive MCU would be released in the middle of the year. Chipsea also announced it is developing the MCU chip, mainly divided into M-series and R-series; the M-series chip is mainly introduced into the manufacturing of bodywork including windows, wipers, lamps, etc.; the R-series chip is introduced into manufacturing chassis and dynamical system. The above products are being developed as planned.

Source from ijiwei.com

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr