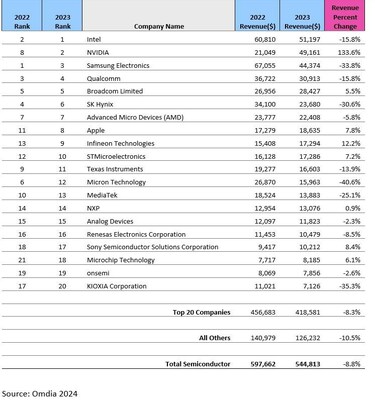

As the industry fell 9% from $597.7 billion in 2022 to $544.8 billion last year, a new growth driver emerged – AI, says Omdia, with NVIDIA dominating the AI chip space so comprehensively that it took the No.2 slot in the overall semiconductor market.

NVIDIA more than doubled its semiconductor revenue from 2022 to $49 billion in 2023. Before the pandemic, in 2029, NVIDIA’s semiconductor revenue was under $10 billion.

High bandwidth memory (HBM) integrated with GPUs to facilitate AI is also seeing strong demand, with SK Hynix leading this segment and other major memory manufacturers venturing into this space.

The memory market had a down year in 2023 overall, while the HBM market had growth of 127% year-over-year in terms of 1Gb equivalent units, throughout 2023. Omdia forecasts that HBM is likely to record 2024 growth rates of 150-200%.

In 2023, the automotive segment exerted greater influence in the semiconductor market as it increased its revenue growth to over 15% in 2023 to over $75 billion. The demand for semiconductors in automotive accounts for approximately 14% of the entire semiconductor market.

The downturn has notably affected major memory makers, traditionally among the top semiconductor companies by revenue. Previously, from 2017 to 2021, Samsung Electronics, SK Hynix, and Micron Technology were all ranked in the top five companies by revenue.

However, amidst the challenging memory market conditions, Samsung Electronics is now ranked third, SK Hynix is ranked sixth, and Micron Technology is ranked twelfth in 2023.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr