PC manufacturers are planning significant price increases on 2026 models as an acute shortage of conventional memory chips, driven by soaring demand for artificial intelligence hardware, tightens supply and inflates component costs, according to reports by ZDNet Korea and cited by Wccftech. The shortage is pushing major PC makers such as ASUS, Acer, and Lenovo toward higher 2026 pricing, with ZDNet Korea reporting industrywide plans for increases of at least 20 percent.

AI demand squeezes PC component supply

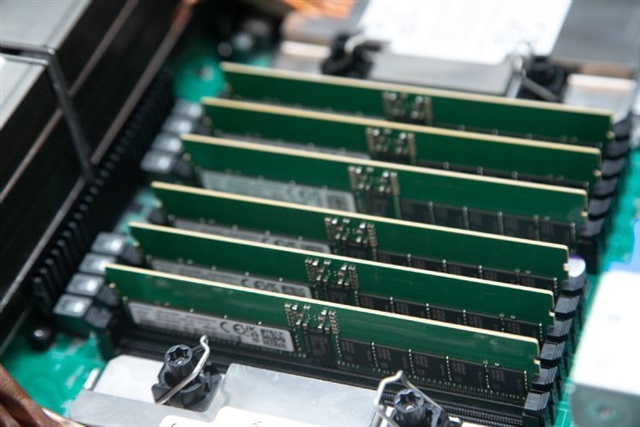

The memory shortage stems from Samsung Electronics, SK hynix, and Micron Technology shifting fabrication capacity to prioritize High-Bandwidth Memory (HBM), a high-margin component essential for AI accelerators. This industry pivot has sharply reduced the availability of mainstream PC components, including DDR5 and LPDDR5 DRAM and SSDs.

Wholesale memory prices, which began rising sharply in late September, continued to accelerate through October, according to ZDNet Korea. A procurement manager at a global PC manufacturer told the outlet that memory prices roughly doubled every ten days early in the fourth quarter. Even after agreeing to higher quotes, manufacturers are frequently receiving only partial shipments. The manager projected that even the largest PC brands will likely secure only about half of their requested memory allocation for next year.

Rising memory costs are compounding price increases across other essential notebook components, including processors and batteries. "PC manufacturers react sensitively even if the cost of production increases by just one cent," the manager noted, adding that systems built after October are already being produced at a loss because retail prices cannot adjust quickly enough.

Vendors accelerate inventory drawdown

To mitigate the squeeze from higher component costs and constrained supply, PC vendors are planning substantial price increases for next year's models. Brands are drawing down inventories and accelerating the phase-out of older product lines, mirroring broader supply-chain pressures recently highlighted in electronics industry coverage.

The supply tightening began earlier this year when major memory suppliers notified customers they would wind down DDR4 production to focus on higher-margin AI memory. Suppliers have cautioned that rapidly expanding mainstream DRAM production could trigger an oversupply cycle, reducing incentives to shift capacity back to PC components.

Shipment forecasts face downside risk

The memory constraint is already impacting the industry outlook. IDC and Gartner have both reduced their PC shipment forecasts for 2026. The unnamed procurement manager warned that actual output could drop more than expected if memory constraints persist, raising the risk of reduced production volumes or temporary manufacturing pauses for certain models.

Next-generation laptops and desktops built around platforms such as Intel's Panther Lake and AMD's Gorgon Point are expected to launch with elevated price tags. Gamers are also likely to face higher system costs as prices for DRAM, SSDs, and graphics components continue to climb.

Alternative memory sources offer limited near-term relief. Chinese supplier CXMT is still ramping up DDR5 production and is not yet supplying meaningful volumes. Supply-chain personnel indicated that the industry is unlikely to see a return to discount cycles for older inventory before 2028, as manufacturers struggle to meet current demand.

The imbalance between high-margin HBM production for AI and conventional PC DRAM is expected to persist into next year as AI-related memory demand continues to climb. Unless major suppliers expand mainstream memory capacity or new entrants scale up production more quickly, PC manufacturers face continued shortages and elevated component costs, making the 2026 product cycle among the most expensive in years.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

hina's National Development and Reform Commission (NDRC) has issued a rare monitoring report warning that rising memory prices are spreading across the electronics supply chain as tight supply and

Nvidia strengthened its dominance in the add-in-board (AIB) GPU market in the fourth quarter of 2025, capturing a record 94% market share even as overall shipments dipped amid rising memory prices and

Broadcom shares rose sharply in aftermarket trade on Wednesday after the artificial intelligence chips maker delivered a quarterly top and bottom-line beat and provided current quarter revenue guidanc