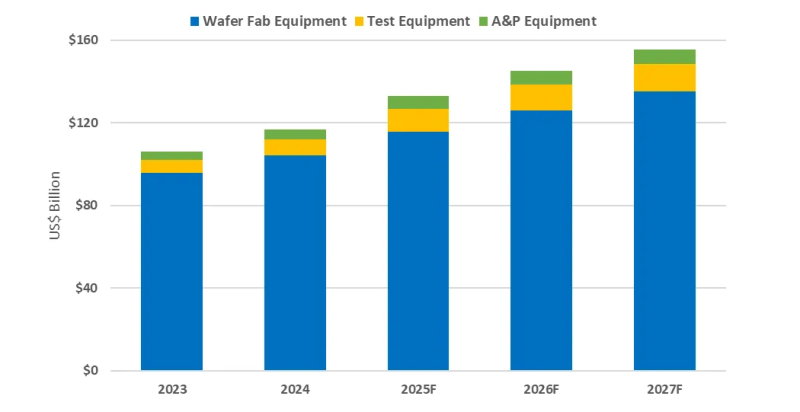

Worldwide semiconductor equipment sales are projected to grow 13.7 percent in 2025, reaching a record 133 billion dollars, Semi announced at Semicon Japan. This momentum is expected to continue through 2026 and 2027, with annual revenues forecast to rise to 145 billion and 156 billion dollars, respectively.

The growth is powered by strong demand for AI-enabling technologies, particularly in leading-edge logic, DRAM and high-bandwidth memory (HBM), as well as the rapid adoption of advanced packaging. Investments in wafer fab equipment (WFE) alone are expected to reach 115.7 billion dollars in 2025, an 11 percent increase over last year.

The back-end segment is also accelerating. Test equipment sales are forecast to jump 48.1 percent to 11.2 billion dollars in 2025, while assembly and packaging equipment will grow 19.6 percent to 6.4 billion dollars. From 2026 through 2027, both front-end and back-end segments are expected to expand steadily as chipmakers scale up for 2nm gate-all-around (GAA) nodes and heterogeneous integration.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr