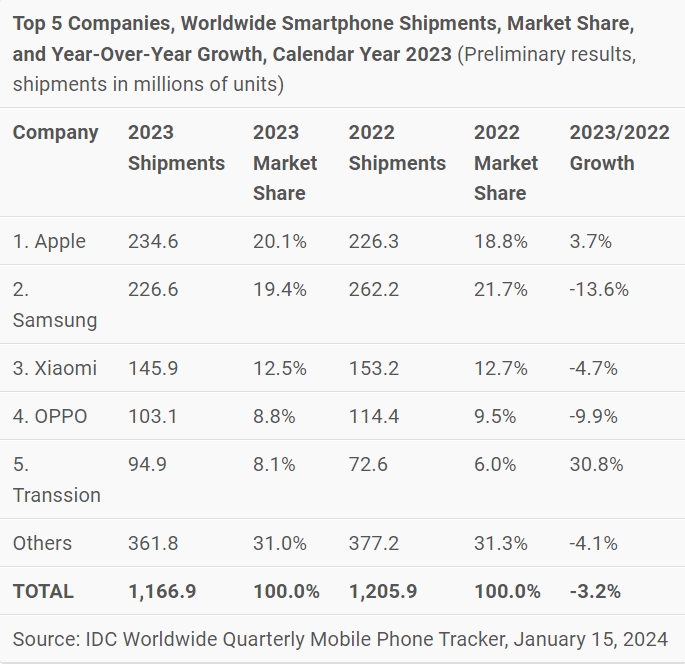

The last time a company not named Samsung was at the top of the smartphone market was 2010. Now it is Apple.

Smartphone shipments declined 3.2% year over year to 1.17 billion units in 2023, says IDC.

While this marks the lowest full-year volume in a decade, growth in the second half of the year has cemented the expected recovery for 2024.

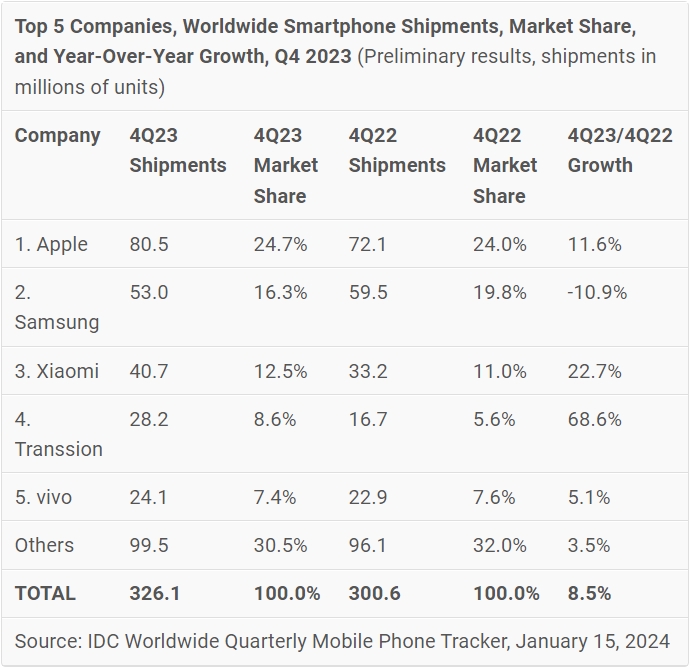

Q4 saw 8.5% y-o-y growth and 326.1 million units shipped.

“While we saw some strong growth from low-end Android players like Transsion and Xiaomi in the second half of 2023, stemming from rapid growth in emerging markets, the biggest winner is clearly Apple,” says IDC’s Nabila Popal, “not only is Apple the only player in the Top 3 to show positive growth annually, but also bags the number 1 spot annually for the first time ever. Apple’s ongoing success and resilience is in large part due to the increasing trend of premium devices, which now represent over 20% of the market, fuelled by aggressive trade-in offers and interest-free financing plans.”

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr