Q1 NAND and DRAM prices are set to rise significantly, reports TrendForce.

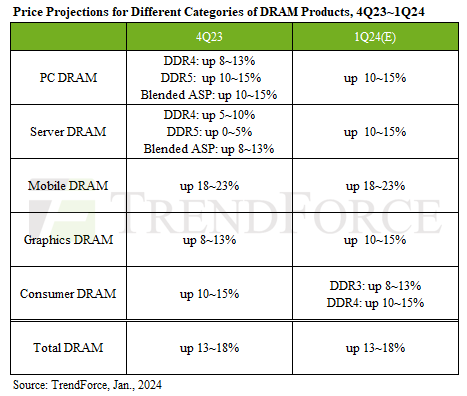

DRAM contract prices are estimated to increase by approximately 13–18% in 1Q24 with mobile DRAM leading the surge.

It appears that due to the unclear demand outlook for 2024, manufacturers believe that sustained production cuts are necessary to maintain the supply-demand balance in the memory industry.

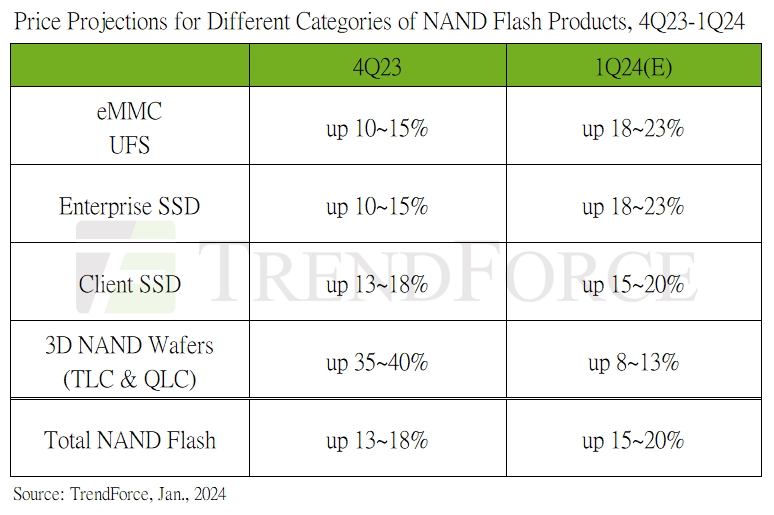

Despite facing a traditional low-demand season, buyers are continuing to increase their purchases of NAND Flash products to establish safe inventory levels.

In response, suppliers, aiming to minimise losses are pushing for higher prices, leading to an estimated 15–20% increase in NAND Flash contract prices in 1Q24.

A key point to note is the aggressive price hike initiated by NAND Flash manufacturers to offset losses. But, with demand struggling to keep pace with these rapid increases, future price escalations hinge on the resurgence of enterprise SSD procurement.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr