5.4 billion sensors, including imaging sensors, magnetic sensors, MEMS pressure sensors among many others, for the automotive market were shipped in 2022, says Yole Developpement, and with a 7% CAGR between 2022 and 2028, 8.3 billion sensors will be shipped in 2023.

For standard, or legacy, image sensors little has changed in terms of the main players, which remain onsemi, Omnivision and Sony. What has changed as safety features evolve, has been an increase in resolution, from 1-2Mpixel to today’s 8Mpixel cameras.

“We see the adoption of more and different sensors due to regulations and in-vehicle comfort levels. There are two routes to autonomous driving – incrementally from L2 to L4 or transitioning directly to L4 and robotaxis,” says Yole’s Yu Yang, “but this is proving more difficult than people first thought.”

On May 31, 2023, the NHTSA, in the US, proposed introducing a new standard that would make AEB mandatory for light-duty cars and trucks within four years of publication.

This regulation would be more stringent and would require detecting pedestrians even in dark conditions. This later condition could be a game changer as current AEB (Automatic Emergency Braking) works well with a radar and a visible camera, but this hardware have very low performance in dark conditions. That would mean that OEMs could implement another sensor to fulfil this condition.

Thermal cameras are insensitive to low light emissions making them superior to emergency braking systems based on a camera and radar. Thermal cameras perform well when the road bends, in poor weather or in low light conditions.

Adding an algorithm for pedestrian detection would be straightforward and this could be a great opportunity for thermal cameras to finally enter the automotive industry, but the cost of a thermal camera compared to a visual one is still the main obstacle to adoption.

Other sensors like gated imaging cameras or LiDAR could also be used to meet the performance required by this new AEB regulation.

The automotive camera and image sensor markets have seen substantial revenue growth due to increased demand and higher prices driven by safety regulations and the chip shortage.

The automotive camera market should rise from 5.4 billion to $9.4 billion in 2028, a CAGR of 9.7%. ADAS cameras will be present in 94% of cars by 2028, while in-cabin cameras for DMS (Driver Monitoring System) and OMS (Occupancy Monitoring System) will experience rapid growth.

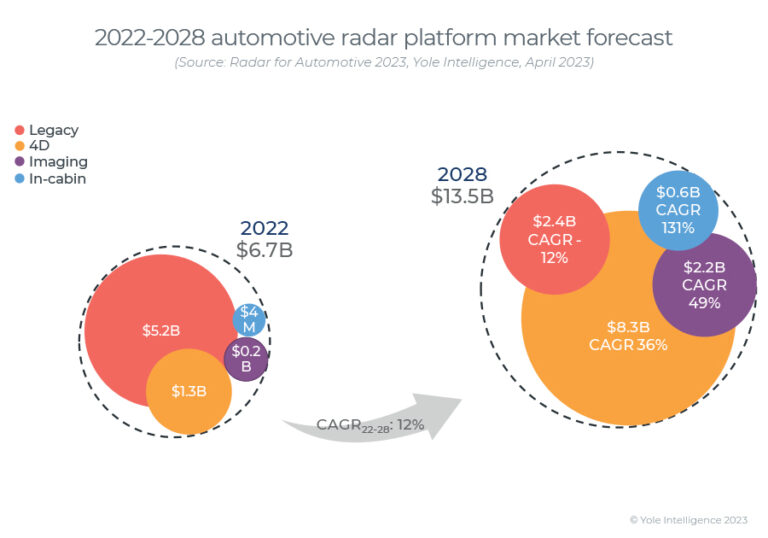

The number of radar modules per car will increase from 1.7 in 2022 to 3.1, on average, in 2028. As a result, the automotive radar module is expected to realise a CAGR of 12% between 2022-2028, growing from $6.7 billion to $13.5 billion. 4D radar is expected to dominate and therefore generate around 60% of the market revenue in 2028.

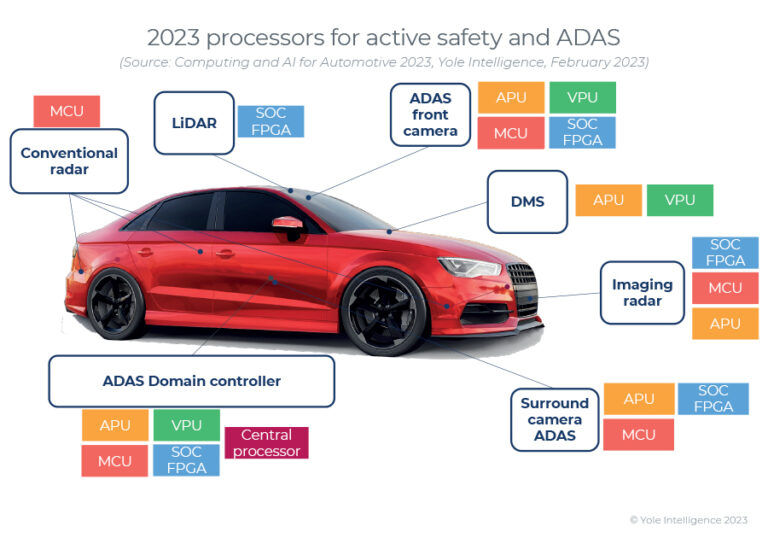

To replace legacy radar, 4D radar comes with the elevation capability and a better resolution. Indeed, 4D radar brings 1° angular resolution which dramatically improves object differentiation compared with 3D radar, which has an angular resolution of 4-6°. But such an increase in performance requires more computing power to process all these data.

Here, innovation is being driven by Arbe Robotics (More News), Uhnder and Metawave. These start-up companies are either using [AMD/Xilinx] FPGAs or, in the case of Arbe Robotics, producing their own ASICs to replace classic MCUs.

In 2023, the computing is usually embedded in the radar module, but in the coming years, we expect to see an increase in the computing part being separated from the radar module.

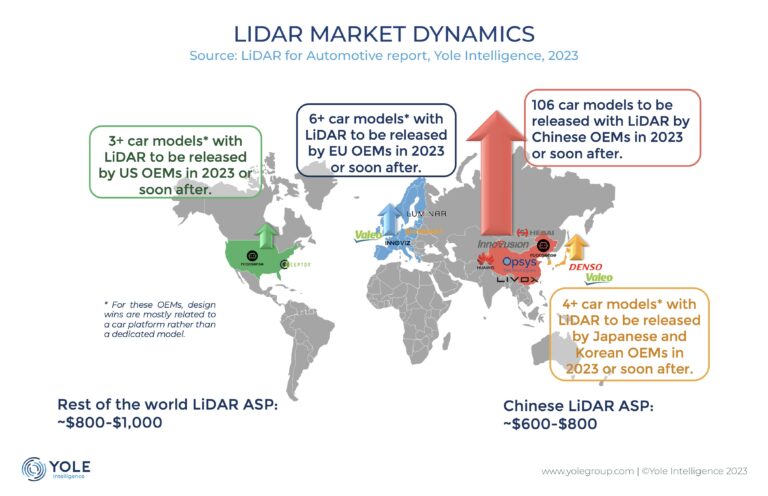

The LiDAR market for passenger cars has increased 285% since 2021. In 2022, and for the first time, the market for LiDAR in passenger vehicles surpassed the LiDAR market for robotaxis. The LiDAR adoption is driven by Chinese OEMs and in particular new ones making fully electric vehicles.

Innovusion, Valeo, Hesai and RoboSense lead this market (More news about LiDAR companies: Here). Valeo has dominated the passenger cars LiDAR market shares, with partnerships with Audi and Mercedes, for example, but dropped from 79% market share in 2021 to 24% in 2022, with the emergence of Chinese suppliers.

In 2022, Innovusion was leading the market thanks to its partnership with Nio but as the LiDAR market is quite young, we expect that the ranking could change rapidly. Indeed, Hesai and Robosense have partnered with more than 14 OEMs each and their respective market shares should change in 2023 and 2024.

Chinese OEMs are rapidly implementing LiDAR using local suppliers to the extent that Chinese LiDAR manufacturers controlled 73% of the market in 2022. They have little traction in Europe, mostly because there are no large programs from OEMs yet and the market is limited to high end, low volume vehicles, mostly supplied by Valeo.

Another consideration relates to an earlier discussion about electrification. China was incentivised to begin electrification 20 years ago and is now developing new platforms for ADAS and AD, which will implement more and more sensors, including LiDAR, camera and radar,” says Yole’s Pierrick Boulay, “for example, the latest BYD model, the Yangwang U8 SUV has 24 sensors between camera, radar and LiDAR, which is more than the fourth-generation of Waymo robotaxi, implementing only 18 of them.

An increasing number of sensors having better performance in terms of range and resolution directly impacts the need for computing power in passenger cars. Computing revenue for ADAS and cockpit processor is increasing quickly, with a 13% CAGR between 2022 and 2028 and reaching a value of $12.7 billion in 2028.

Among these two categories, ADAS is the largest segment, representing more than 60% of the revenue in 2028.

Mobileye has dominated the automotive vision processor market for a long time, accounting for 52% market share in 2022, followed by players like AMD, Nvidia or Tesla.

The cockpit processor market is dominated by Qualcomm, a new player compared to competitors, Renesas or NXP.

Qualcomm entered the automotive market through the cockpit, leveraging its knowledge in user experience, acquired in the smartphone market. But the ultimate goal of Qualcomm is not the cockpit market, it is the much more lucrative ADAS market. Yole expects that Qualcomm will rapidly gain some market share in the ADAS domain and quickly become a significant player to compete with Mobileye.

Already some players, such as BMW and Volkswagen, are moving away from Mobileye to Qualcomm. Other new players e.g., Nvidia, Horizon Robotics and Black Sesame have a low but rapidly growing market share,thanks to partnerships with Chinese OEMs.

Today, Chinese companies like Horizon Robotics, Black Sesame or Hisilicon, among others, are gaining design wins and their market share is expected to increase significantly in the next five years. They are very active in both ADAS and cockpit domains.

In 2023, several car models from Chinese OEMs were released with a number of sensors that was much higher compared to other car models released by European or US OEMs. But these Chinese cars are still classified in the hands-off category, like Tesla to give a comparison, due to a lack of regulation.

If the regulation changes, we could expect more complex automated driving applications that would be enabled via OTA updates, as the sensor and computing hardware is already in place.

Regarding eyes-off applications, there is no regulation in place in China to allow such applications, but Chinese OEMs are developing NOA (Navigation On Autopilot) systems. Regarding the rest of the world, eyes-off regulation is already in place in Japan, Europe (Germany) and it is also gathering pace in the UK and some states in the U.S, for example, California and Nevada.

Without doubt, the main driver of the automotive semiconductor industry is electrification and ADAS.

The cost of semiconductor devices in cars reached around $540 per car in 2022. In 2028, this figure will grow to about $912 entirely through the implementation of both market drivers.

The related market is showing a significant 11.9% CAGR between 2022 and 2028 to peak at $84.3 billion during this period. Behind this figure, Yole expects a 100 billion semiconductor device market.

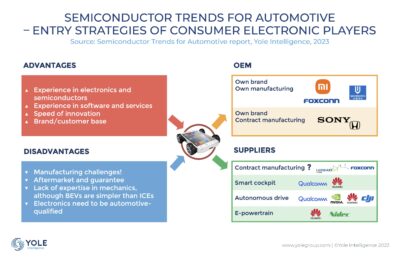

Although semiconductors are critical to the on-going disruptive transition in the automotive industry, most players, whether OEMs or Tier 1s, do not yet have a well-defined strategy for semiconductors.

Specific expertise in semiconductor technologies and the supply chain is needed to prepare for the future. There is a need to manage semiconductor complexity. OEMs need to prioritize essential ECUs and semiconductors and establish new relations with device manufacturers and foundries.

OEMs need to secure their supply chain and to do that they are developing new strategies with semiconductor manufacturers, whether it is direct sourcing by partnering with companies like Infineon or onsemi, for example, or by co-development, partnering with companies like STMicroelectronics or Foxconn.

The global supply chain is evolving from OEMs buying a black box to Tier 1 players being more involved in the development of their products. Some OEMs, like BYD, Toyota, or Geely, can be vertically integrated in some domains and able to manufacture their own semiconductors.

Others, like Li Auto or Tesla, can control the design of their devices and only use foundries to manufacture them. Here are only few examples of these changes and 2024 will be a strategic year for all automotive companies

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr