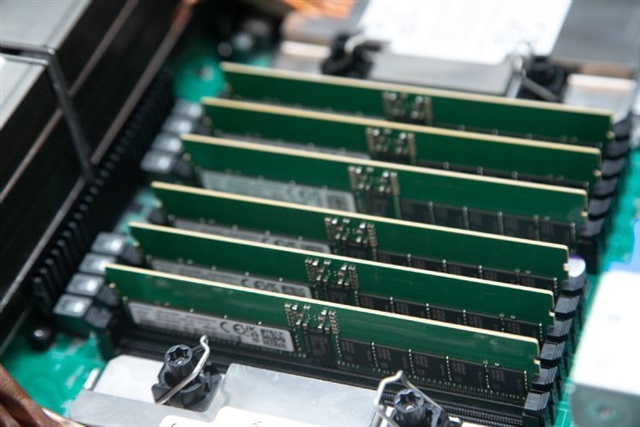

In observing surging DDR5 prices, securities analysts predict that DDR5 profits in 2026 could surpass those of HBM. According to Newsis, Samsung Electronics raised contract prices for DDR5 modules by 60% in just two months and plans to further expand DDR5 production. Reuters has also reported that Samsung had increased supply prices for some memory products by up to 60%.

Data from semiconductor distributor Fusion Worldwide shows that the November contract price for Samsung's 32GB DDR5 modules was US$239, up 60% from September. Contract prices for 16GB and 128GB DDR5 modules also rose 50% over the same period.

DDR5 is primarily used in AI servers and high-performance computing. With AI data center and cloud construction booming, demand continues to rise. This price surge is mainly AI-driven, with memory supply increasingly tight.

Some analysts feel that the market is panic-buying. If DDR5 maintains its current price level, profit performance could soon surpass HBM. KB Securities recently stated that DDR5 profitability in 2026 is expected to exceed HBM, with Samsung to directly benefit. Since 70% of Samsung's DRAM production capacity is general-purpose DRAM, it stands to gain far more than competitors from rising DDR5 prices. Therefore, Samsung is anticipated to significantly increase DDR5 production.

With AI data centers continuing construction, the industry expects DDR5's high profitability to persist for some time. DDR5's stable manufacturing process and higher yields compared to the latest HBM, along with its suitability for mass production, provide a solid profitability foundation. Analysts predict Samsung will expand HBM production while simultaneously increasing DDR5 output to maximize revenue. To meet memory demand, Samsung has restarted construction of its fifth factory (P5) in its Pyeongtaek campus in South Korea, with HBM and DDR5 production expected to begin in 2028.

According to market research firm ChinaFlashMarket (CFM), Samsung held a 34.8% share of the global DRAM market in the third quarter of 2025, surpassing SK Hynix's 34.4% by approximately 0.4pp, successfully regaining the DRAM leadership position. In the first quarter of 2025, Samsung had ceded the DRAM top spot to SK Hynix. After two quarters, it has reclaimed the position. Analysts attribute Samsung's return to the top mainly to the significant increase in HBM supply and the simultaneous rise in general-purpose DRAM prices.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

hina's National Development and Reform Commission (NDRC) has issued a rare monitoring report warning that rising memory prices are spreading across the electronics supply chain as tight supply and

Nvidia strengthened its dominance in the add-in-board (AIB) GPU market in the fourth quarter of 2025, capturing a record 94% market share even as overall shipments dipped amid rising memory prices and

Broadcom shares rose sharply in aftermarket trade on Wednesday after the artificial intelligence chips maker delivered a quarterly top and bottom-line beat and provided current quarter revenue guidanc