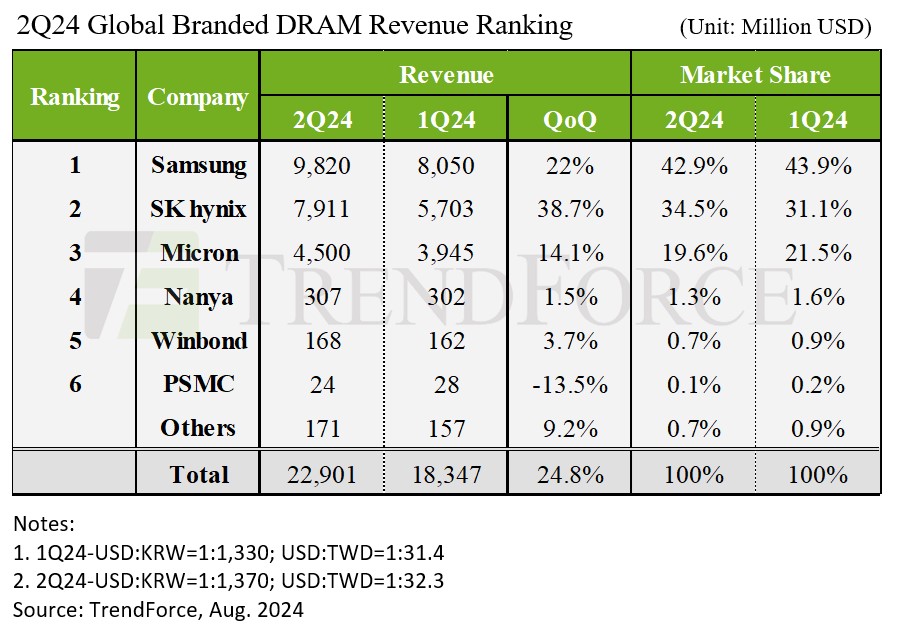

TrendForce’s latest findings reveal that the DRAM industry saw a significant revenue increase to US$22.9 billion in the second quarter of 2024—a QoQ growth of 24.8%. This surge was driven by expanded shipments of mainstream products that boosted revenue for most manufacturers. Contract prices remained on an upward trend in the second quarter, and due to geopolitical factors, the increase in conventional DRAM contract prices for the third quarter is now expected to exceed previous forecasts.

Key players Samsung, SK hynix, and Micron all reported increased shipments in Q2 compared to the previous quarter. ASP also continued to rise following the first quarter’s trend. Contributing factors included the earthquake that struck Taiwan in early April and the high demand for HBM products, which shifted DRAM buyers toward more aggressive procurement strategies. Consequently, Q2 contract prices saw a final adjustment of 13%–18%.

TrendForce highlighted that Samsung benefited from a 17%–19% increase in ASP, with bit shipments also rising slightly, leading to revenue growth for DRAM of 22% to $9.82 billion as the company maintained its market-leading position. SK hynix saw its bit shipments increase by over 20%—driven by the certification and mass shipment of its HBM3e products—resulting in a substantial revenue increase of 38.7% to $7.91 billion. Micron’s Q2 revenue rose by 14.1% to $4.5 billion despite a slight decrease in ASP, as bit shipments grew by 15%–16%. However, the company’s aggressive clearance of low-cost 1-beta nm DDR5 inventory in Q2 caused it to lag behind its major competitors.

In terms of profitability, the rise in DRAM contract prices, full utilization of production capacity, reversal of inventory write-down losses, and higher sales of premium products such as DDR5 and HBM allowed manufacturers to maintain profitability in Q2. Samsung’s operating profit margin increased from 22% in the previous quarter to 37%, SK hynix saw a rise from 33% to 45%, while Micron’s operating profit margin improved from 6.9% to 13.1% due to lower contributions from HBM products.

Taiwanese manufacturers showed varied performances in Q2. Nanya Technology experienced a slight decline in shipments due to weaker consumer DRAM sales, but higher ASPs improved its operating margin from -30.7% to -23.4%. Winbond increased contract prices for high-density products and boosted ASP by 24%–26%. This led to a 3.7% QoQ revenue growth to $168 million, which was also driven by higher sales of low-density, high-priced products. PSMC saw a 13.5% decline in consumer DRAM revenue but a 2.2% increase in total revenue when including foundry services that reflected their clients’ proactive inventory buildup.

· Upward revision of Q3 DRAM contract prices reflects geopolitical factors

TrendForce notes that most DRAM manufacturers concluded Q3 contract price negotiations with PC OEMs and CSPs in late July 2024, with results exceeding expectations. Consequently, TrendForce has revised the Q3 contract price increase for conventional DRAM to 8%–13%—approximately 5 percentage points higher than the previous forecast.

Chinese CSPs have been fearing new US sanctions on their AI chips or memory purchases since Q2. In response, they have been aggressively stockpiling, doubling their procurement scale compared to the same period last year. This has driven DRAM manufacturers to lock in higher prices and pressured US CSPs to adjust their procurement prices upward. The increased server DRAM prices have also positively impacted negotiations for PC DRAM contract prices.

Furthermore, Samsung has started producing HBM3e wafers in its factories to ensure timely shipments following HBM3e product verification. This will likely affect DDR5 production schedules for the second half of 2024. Manufacturers are finalizing their 2025 capacity plans, with SK hynix and Samsung prioritizing HBM production over DDR5, indicating that DRAM prices are unlikely to fall in the coming quarters.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr