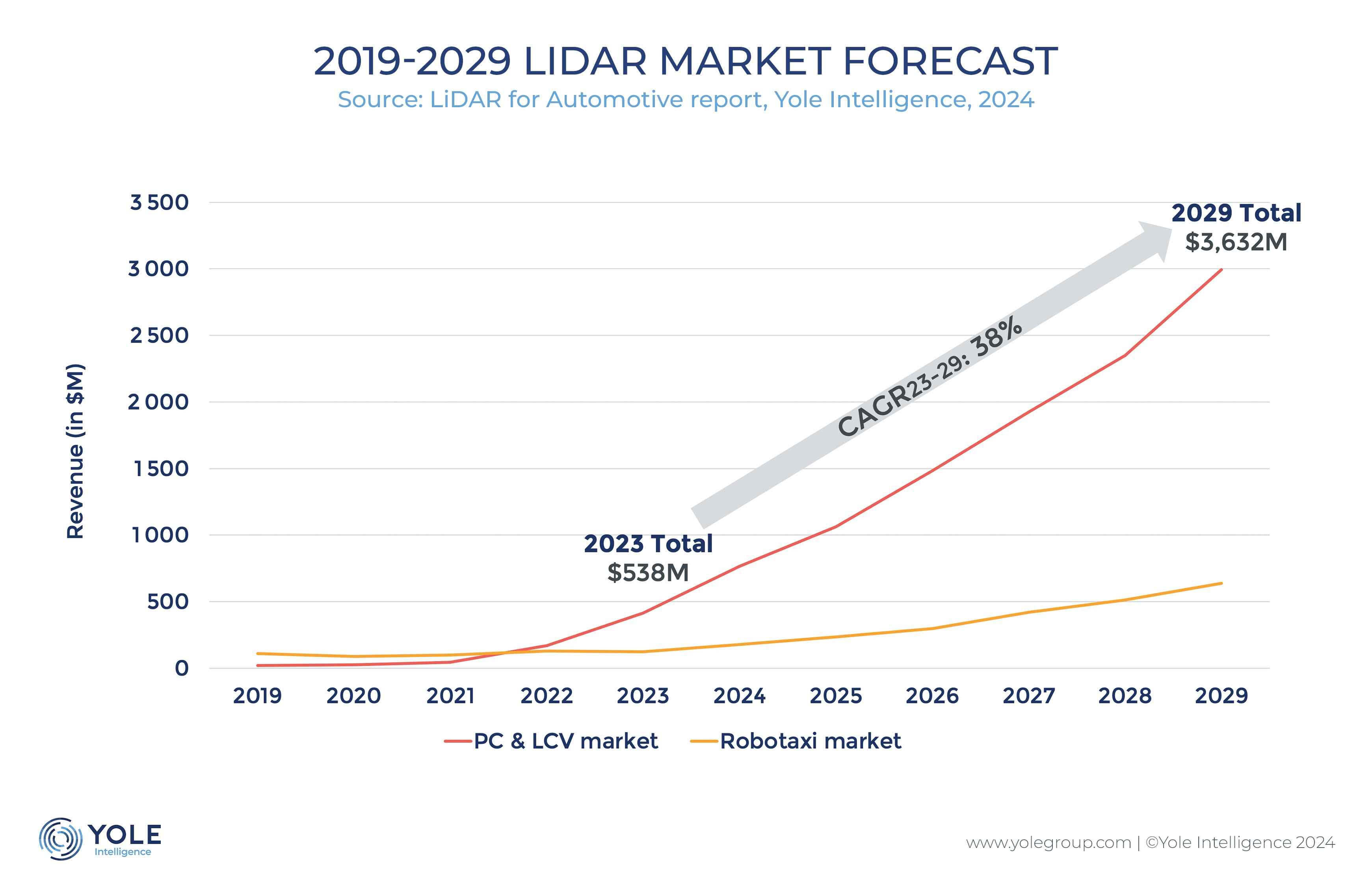

The global LiDAR market for automotive is expected to grow from $538 million in 2023 to $3,632 million in 2029 at a 38% CAGR 23-29, says Yole Group.

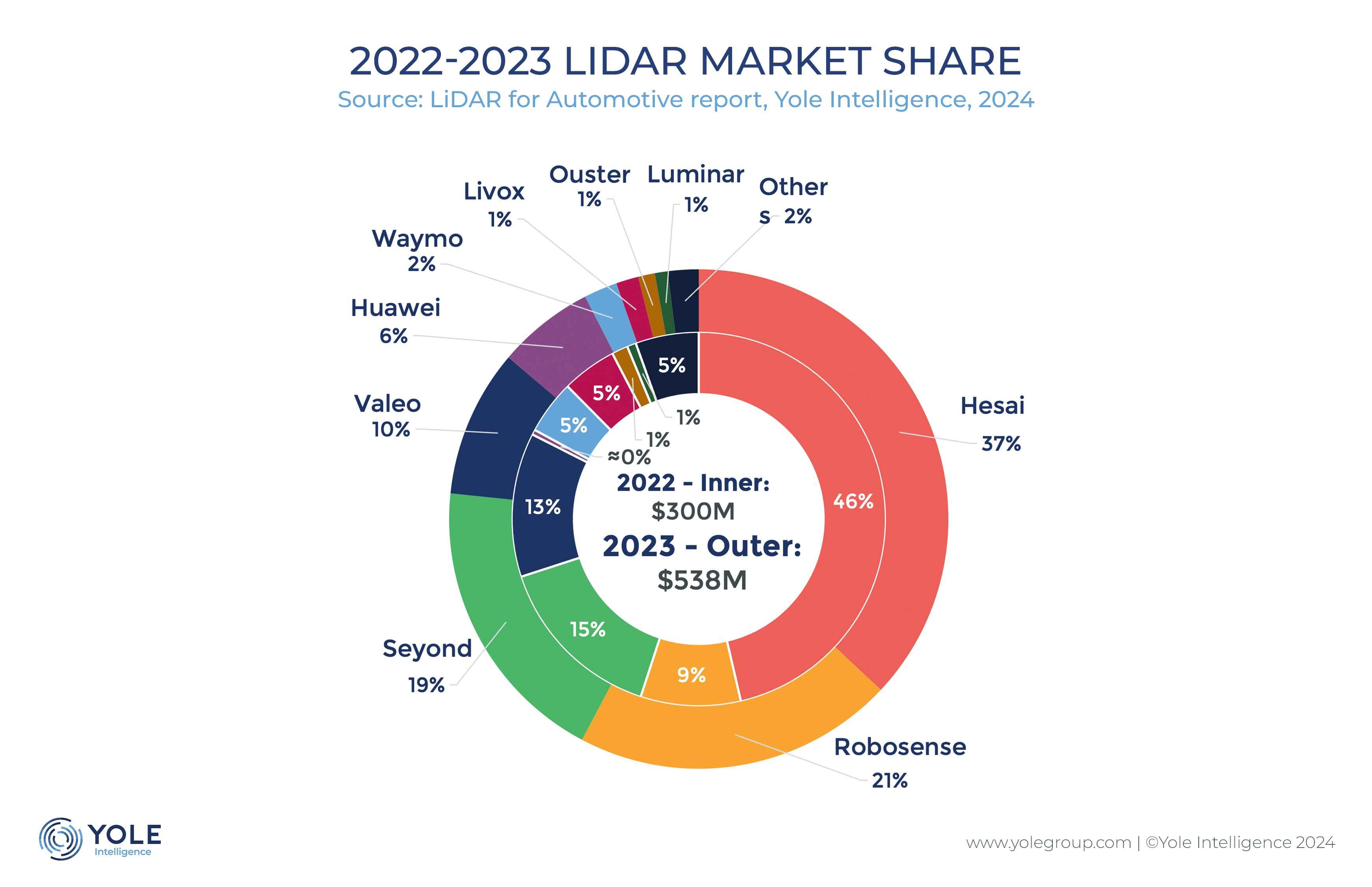

Chinese OEMs are pushing for the integration of LiDAR in their vehicles. In 2024, Hesai and RoboSense are expected to continue leading the passenger car LiDAR market.

LiDAR manufacturers are now producing higher volumes and new technologies, which should reduce the cost of LiDAR.

In 2022, the market was at a crucial junction with significant differences between the PC (Passenger Car) and LCV (Light Commercial Vehicle) segment and the robotaxi segment. By 2023, however, the PC&LCV market had clearly taken the lead.

“The journey of robotaxi services began in August 2016 with NuTonomy’s launch in Singapore,” says Yole’s Pierrick Boulay, “this was followed by a significant milestone in 2017, the entry of Waymo and Cruise in Phoenix, AZ, and San Francisco, CA. Subsequently, Chinese companies such as DiDi, AutoX, and Baidu joined the fray, rolling out services in various cities across the globe. This rapid proliferation of robotaxi services pushed the LiDAR market for robotaxis significantly ahead of that for passenger cars.”

However, in 2023 and 2024, Waymo and Cruise markedly slowed their operations due to a series of incidents, directly impacting the robotaxi market. This slowdown could also affect the long-term market outlook as these companies strive to regain public trust.

In 2023, the robotaxi market was valued at $124 million, while the PC&LCV market stood at $414 million. The passenger car market, more than three times the size of the robotaxi market, is experiencing a substantial take-off.

Yole’s Automotive LiDAR Comparison 2024 report has an overview of the technology choices from 4 leading LiDAR companies, Valeo, RoboSense, Seyond, and Hesai, together with a detailed cost comparison.

Since 2018, nearly 200 design wins have been noted, with 124 scheduled for commercialisation in 2024 or soon thereafter.

Notably, almost 90% of these are from Chinese OEMs, who are aggressively pushing to integrate LiDAR into their vehicles.

Unlike their European and US counterparts, which primarily limit LiDAR to the high-end F segment, Chinese OEMs are incorporating LiDAR into the more affordable D segment.

In 2023, the first LiDAR-equipped car in the C segment was introduced. These vehicles are much more affordable than those in the F segment, leading to higher production volumes of LiDAR-equipped cars and consequently driving significant price reductions for LiDAR technology.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

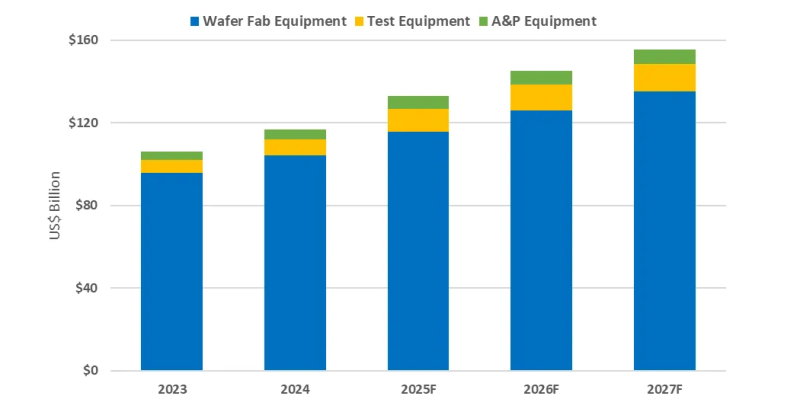

Worldwide semiconductor equipment sales are projected to grow 13.7 percent in 2025, reaching a record 133 billion dollars, Semi announced at Semicon Japan. This momentum is expected to continue throug

The smartphone industry is facing considerable cost challenges in 2026 amid ongoing memory supply shortages and rising prices. This situation is expected to lead to a 1.6% decrease in annual shipments

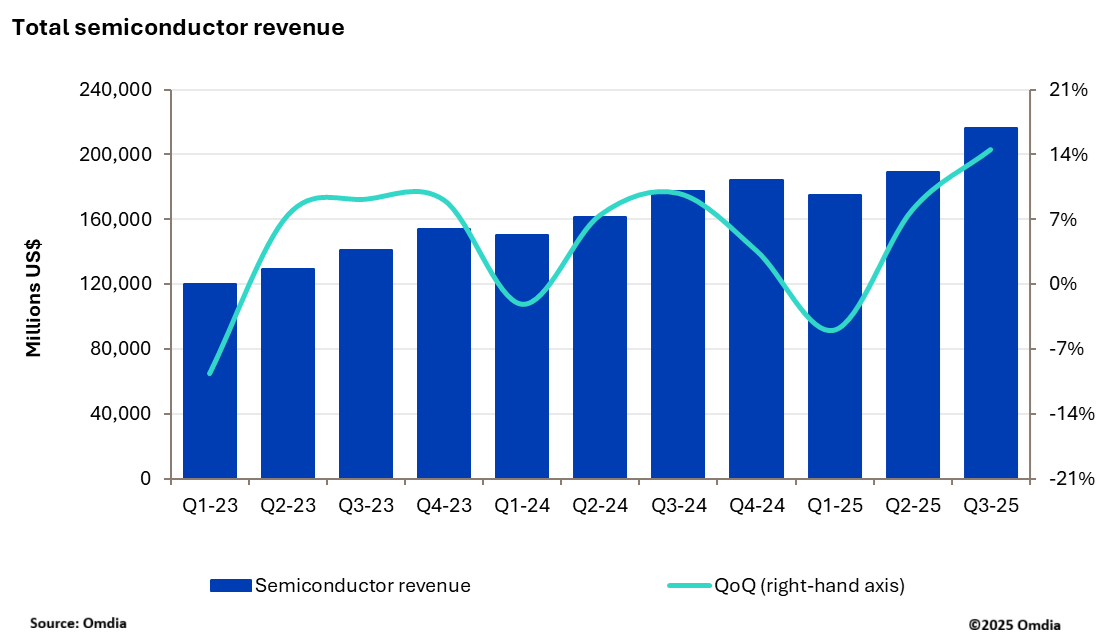

New research from Omdia shows that the semiconductor market delivered a record breaking performance in 3Q25 with industry revenue reaching $216.3bn, up 14.5% quarter-over-quarter (QoQ). This marks the