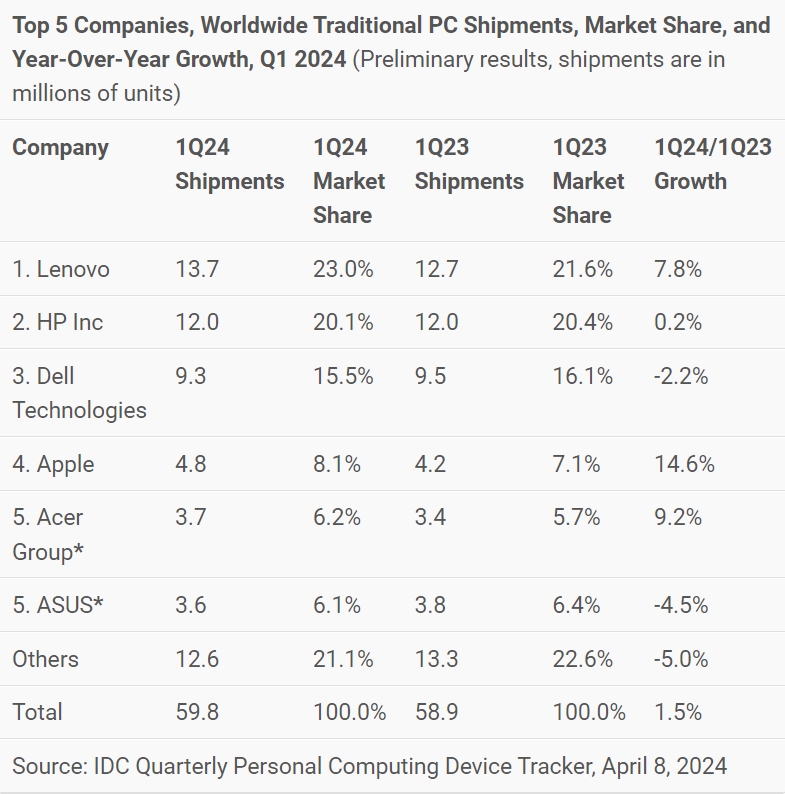

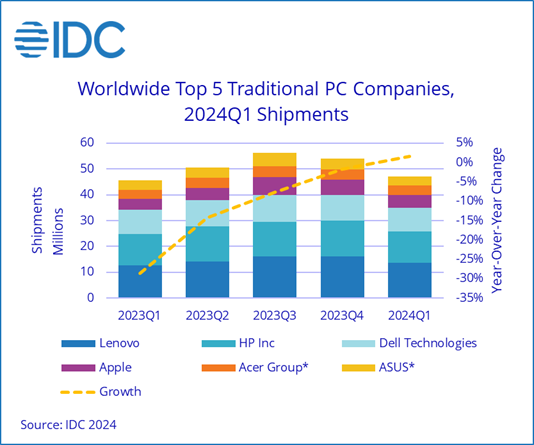

After two years of decline, the worldwide traditional PC market returned to growth during the first quarter of 2024 (1Q24) with 59.8 million shipments, growing 1.5% year over year, according to IDC

RECOMMENDED ARTICLESHMI claims smallest SIM card level translatorNordic into tracking with GoogleCurren steps down as CEO of SondrelTSMC gets $11.6bn funding and ups US spend to $65bnIn Q1 2023, the market declined 28.7% – the biggest drop in PC history.

In Q1 2024, global PC shipments finally returned to pre-pandemic levels as volumes rivaled those seen in 1Q19 when 60.5 million units were shipped.

With inflation numbers trending down, PC shipments have begun to recover in most regions, leading to growth in the Americas as well as Europe, the Middle East, and Africa (EMEA). However, the deflationary pressures in China directly impacted the global PC market.

As the largest consumer of desktop PCs, weak demand in China led to yet another quarter of declines for global desktop shipments, which already faced pressure from notebooks as the preferred form factor.

“Despite China’s struggles, the recovery is expected to continue in 2024 as newer AI PCs hit shelves later this year and as commercial buyers begin refreshing the PCs that were purchased during the pandemic,” says IDC’s Jitesh Ubrani.

Among the top 5 companies, Lenovo once again held the top spot and outgrew the market largely due to the steep decline in shipments experienced in 1Q23.

Apple’s strong growth was also due to an outsized decline in the prior year.

Notes:

* IDC declares a statistical tie in the Personal Computing Device market when there is a difference of one tenth of one percent (0.1%) or less in the shipment shares among two or more vendors.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr