Sensors for electrification and ADAS are showing remarkably strong growth between 2019 and 2029, with 24% and 17% CAGR, respectively, reports Yole Developpement.

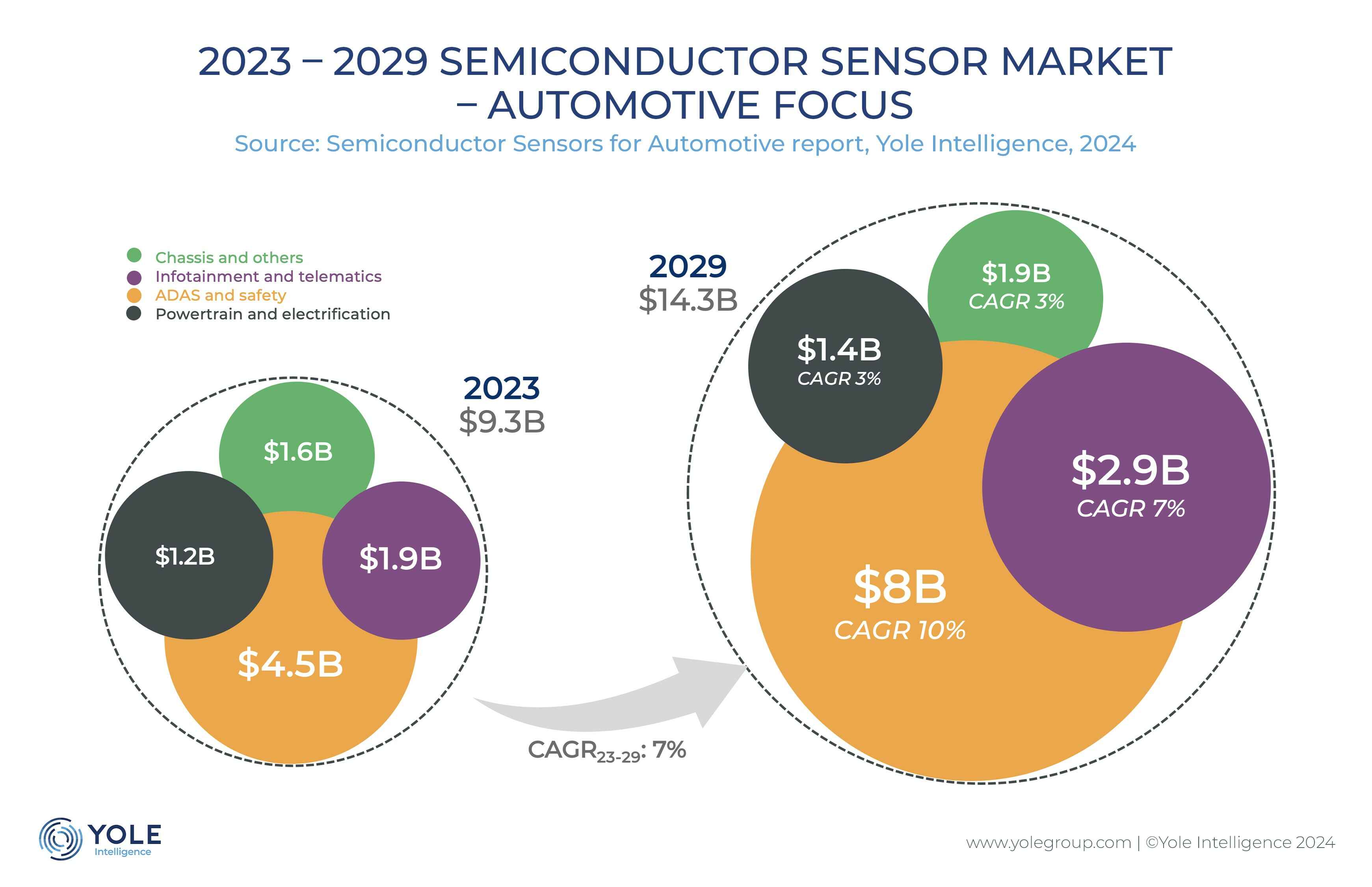

6.5 billion semiconductor sensors for automotive applications were shipped last year generating revenue of $9.3 billion and demand is pointing to a 9 billion unit market with revenue of $14.3 billion by 2029 at a 7% CAGR between 2023 and 2029.

“The upcoming years are poised to witness a dynamic transformation in automotive sensor technology driven by advancements in ADAS, autonomous driving, electrification, and the widespread adoption of sensors across global car fleets,” says Yole’s Pierrick Boulay, “consequently, substantial reorganization within the industry and its supply chain is anticipated.”

The biggest segments are radars and CIS, with more than $4 billion and more than $3 billion, respectively, in 2029. LiDARs will have the biggest growth at 48% to $649 million during the 2019-29 period.

Bosch, leads the market due to strong revenue in MEMS (pressure, accelerometer, IMU) and radar.

During these coming years, the automotive industry is expected to go through massive transformations in all four car domains:

In powertrain and electrification, the automotive industry is transitioning from cars based on internal combustion engines (ICE) to electrified cars, which are expected to represent 43% of production in 2029.

In terms of sensors, this segment will grow with a 3% CAGR between 2023 and 2029. In the long term, the electrification of cars will induce critical changes in the sensor landscape by giving birth to new applications while removing others.

In the ADAS and safety segment, cars are becoming more intelligent, enhancing safety while driving autonomously. Revenue is by far the largest of all segments and Yole forecasts about $8 billion in revenue by 2029.

Infotainment and telematics: with customers demanding greater entertainment options for both drivers and passengers, this sector is projected to achieve a favorable 7% CAGR from 2023 to 2029. This segment should exceed $2.9 billion by 2029.

In the chassis domain, OEMs strive to improve passenger safety, send valuable data to the ADAS computing unit, and even remove hydraulic systems in the car. In this context, the global sensorization of cars is driving sensor volumes to a 3% CAGR between 2023 and 2029. In terms of revenue, Yole Group expects almost $1.9 billion to be generated in 2029.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr