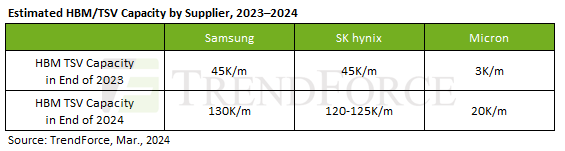

By the end of 2024, the DRAM industry is expected to have allocated approximately 250K/m (14%) of total capacity to producing HBM TSV, with an estimated annual supply bit growth of around 260%, says TrendForce svp Avril Wu.

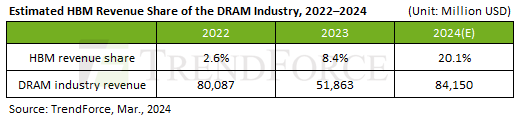

HBM’s revenue share within the DRAM industry—around 8.4% in 2023—is projected to increase to 20.1% by the end of 2024.

The die size of HBM is generally 35–45% larger than DDR5 of the same process and capacity (for example, 24Gb compared to 24Gb).

The yield rate (including TSV packaging) for HBM is approximately 20–30% lower than that of DDR5, and the production cycle (including TSV) is 1.5 to 2 months longer than DDR5.

HBM has a longer production cycle than DDR5 – over two quarters from wafer start to final packaging.

Samsung’s total HBM capacity is expected to reach around 130K (including TSV) by year-end; Hynix’s capacity is around 120K.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr