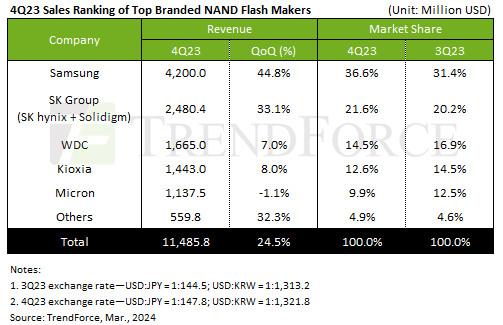

Q4 saw a 24.5% QoQ increase in NAND revenue reaching $11.49 billion, reports TrendForce.

Q1 is forecast to see a further 20% increase in revenues and a 25% increase in contract prices.

Samsung’s bit shipment volume increased by 35% QoQ, coupled with a 12% increase in ASP, boosting its revenue to $4.2 billion—a 44.8% QoQ growth.

Hynix had a 33.1% revenue jump to $2.48 billion.

Western Digital had 2% dip in shipment volume but a 10% increase in ASP, leading to a 7% revenue increase to $1.67 billion.

Kioxia had an 8% revenue increase to $1.44 billion in Q4.

Micron reduced its supply significantly to improve profitability, leading to a more than 10% QoQ decrease in bit shipments and a 1.1% decrease in revenue to $1.14 billion.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr