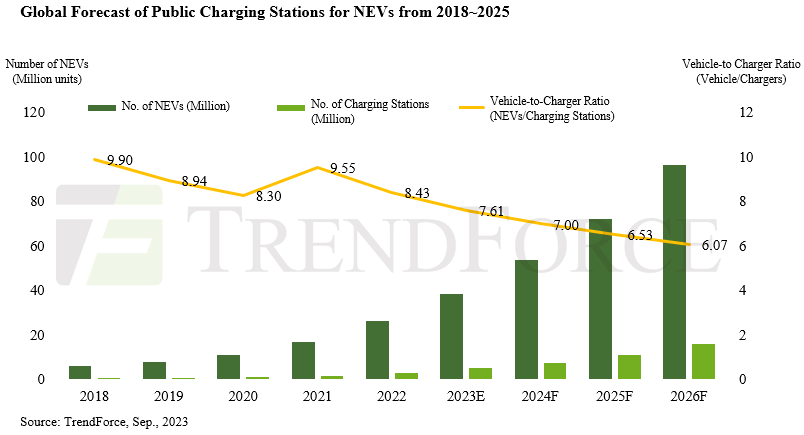

The number of EV charging stations across the world will increase 3x between 2023 and 2026 to 16 million charging points, says TrendForce.

By 2026, the number of EV’s will be 96 billion globally setting the vehicle-to-charger ratio at 6:1, a significant drop from the 10:1 ratio in 2021.

Europe is targeting the construction of 17 million charging stations by 2030.

America, with a little over 200,000 charging stations currently, aspires to hit the 500,000 mark by 2026 which will coincide with a projected EV count of 15 million, delivering a vehicle-to-charger ratio to 32:1.

Around the same period, Europe and China are projected to have ratios of approximately 9:1 and 4:1, respectively.

NEV owners globally grapple with a maze of charging standards. Prominent among these are the US standard CCS1 (Combo), the European standard CCS2 (Combo), Japan’s CHAdeMO, China’s GB/T, and Tesla’s NACS standard. Europe and China offer a simpler scenario for their citizens by adhering to a single domestic standard.

In contrast, the US is a battleground, with both CCS1 and NACS standards vying for dominance. While adapters provide a temporary bridge between the two, the rapid rise of NACS kindles apprehension among CCS1 aficionados about their future stake.

A diverse array of charging standards across the globe means charging equipment manufacturers must adopt flexible product strategies to cater to different market specifications.

GM, Mercedes-Benz, BMW, HONDA, Hyundai-Kia, and Stellantis are joining forces to spin off dedicated charging infrastructure companies.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr