In 2023, global sales in the technology industry reached $527 billion, with nearly 1 trillion semiconductors sold—equating to over 100 chips for every single person on the planet.

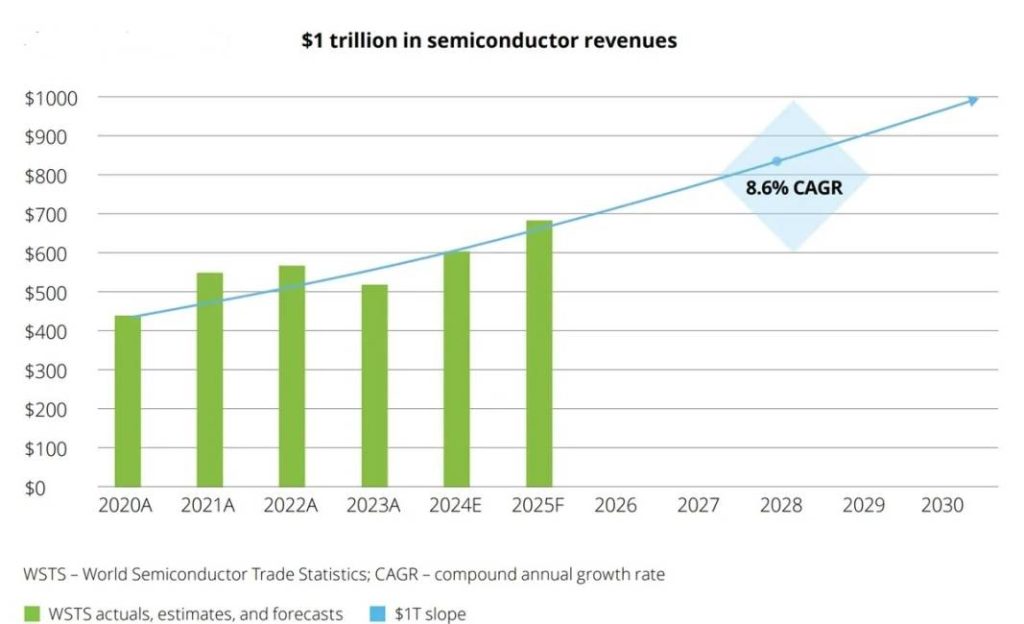

With the cyclical market downturn behind us and demand remaining strong, World Semiconductor Trade Statistics projects that sales will surpass $600 billion in 2024.

Rising demand has led to significant investments in chip production. Fueled in part by the landmark CHIPS and Science Act, the United States is projected to more than triple its semiconductor fabrication capacity and attract a larger share of private investment in manufacturing.

Since the introduction of the CHIPS Act, semiconductor companies have announced over 90 new manufacturing projects across 28 states, totaling nearly $450 billion in investments.

The initiatives are expected to create tens of thousands of direct jobs and support hundreds of thousands more in the broader U.S. economy.

Additionally, the industry is making global investments to build a more robust and resilient supply chain, with projections suggesting that the semiconductor sector could reach a value of $1 trillion by 2030.

While expanding domestic chip supply chains offers tremendous opportunities, it also presents challenges. As U.S. chip operations grow, the demand for skilled talent will increase.

Other policy hurdles remain, including effective implementation of the CHIPS Act, reinforcing U.S. leadership in semiconductor research, design, and manufacturing, and ensuring access to overseas markets for domestically produced chips.

2024 Semiconductor Industry Outlook

Despite a challenging global landscape for mergers and acquisitions, semiconductor M&A activity surged in 2024, increasing from 33 to 44 transactions.

The total deal value skyrocketed from $2.7 billion to $45.4 billion, primarily driven by two significant EDA transactions: Synopsys’s acquisition of Ansys for around $35 billion and Renesas’ acquisition of Altium for approximately $5.9 billion.

Additionally, the processor, discrete, and wireless sectors experienced a boost in M&A activity due to rising demand for AI processing and high-performance capabilities.

Semiconductor companies have also expanded their solution platforms by acquiring non-chip businesses, with notable transactions from NVIDIA and AMD already this year.

Although private equity activity has been limited so far, interest in semiconductor and component businesses is growing, which is expected to lead to increased activity from financial buyers, particularly in stable, high-margin markets like medical, industrial, and aerospace & defense.

Record High SOX Index: Powered By NVIDIA

The PHLX Semiconductor Index (SOX) continues to outperform major indices, boasting impressive returns of 65% in 2023 and a 24% gain year-to-date in 2024. The performance highlights a stark contrast within the sector, as the index is heavily influenced by a small number of companies.

As of August 1, 2024, the ten largest constituents made up approximately 60% of the index weight, with six of these top ten firms seeing their share prices more than double since early last year, averaging a remarkable gain of 226.9%.

After surpassing the $3 trillion valuation mark in June, Nvidia has become the focal point in the sector, accounting for over 10% of global semiconductor revenue. NVIDIA stands out as the top performer, with an astonishing 8.2x increase in share price.

Additionally, the SOX index was further boosted by adjustments made in April 2024 to the weight caps of the top five companies.

Previously, the individual weight of each of the top five constituents was limited to 8% by market capitalisation. Under the new methodology, the caps for the top three constituents are now set at 12%, 10%, and 8%.

Since the beginning of 2023, the SOX index has also seen a roughly 40% expansion in its valuation multiple, with the next twelve months (NTM) EBITDA multiple rising from 17.3x to 24.2x.

Intel also reported $15.4 billion in revenue with a 46% gross margin during the same period. The stark contrast underscores the significant stakes involved in the AI sector.

The Need For Semiconductor Talent Is A Global Issue

Companies can’t expect to thrive, expand existing fabs, or keep pace with rapid technological advancements while competing over a limited talent pool.

In the United States, a significant portion of graduates with master’s degrees in semiconductor-related engineering fields are foreign students, and alarmingly, 80% of them leave the country after graduation.

Deloitte’s recent APAC Semiconductor Industry Trends Survey revealed that 90% of companies prioritise talent acquisition and development to ensure growth and competitiveness, while 63.3% see talent capability and retention as major risks.

As Asia seeks to broaden its semiconductor industry beyond its traditional players, it will also face significant shortages.

For instance, India is projected to have a deficit of 250,000 to 300,000 semiconductor professionals by 2027.

Similarly, for the European Union to achieve its goal of doubling its market share by 2030—set out in the European Chips Act—it will need an estimated 400,000 additional workers.

In the U.S., the Semiconductor Industry Association estimates that over 100,000 new jobs in manufacturing and design will emerge by 2030, yet 67,000 of those positions may go unfilled. The industry urgently needs to address these talent shortages to sustain its growth.

In 2022, Deloitte also projected that the global semiconductor industry would require an additional million skilled workers by 2030, averaging over 100,000 new hires each year. Two years later, the forecast remains unchanged.

Governments around the world are also focused on enhancing supply chain resilience for chip production and upstream materials to reduce strategic dependencies.

Meanwhile. the industry is committed to ensuring that global semiconductor supply chains remain resilient, promoting access to international markets, and facilitating increased global trade through deeper collaboration.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr