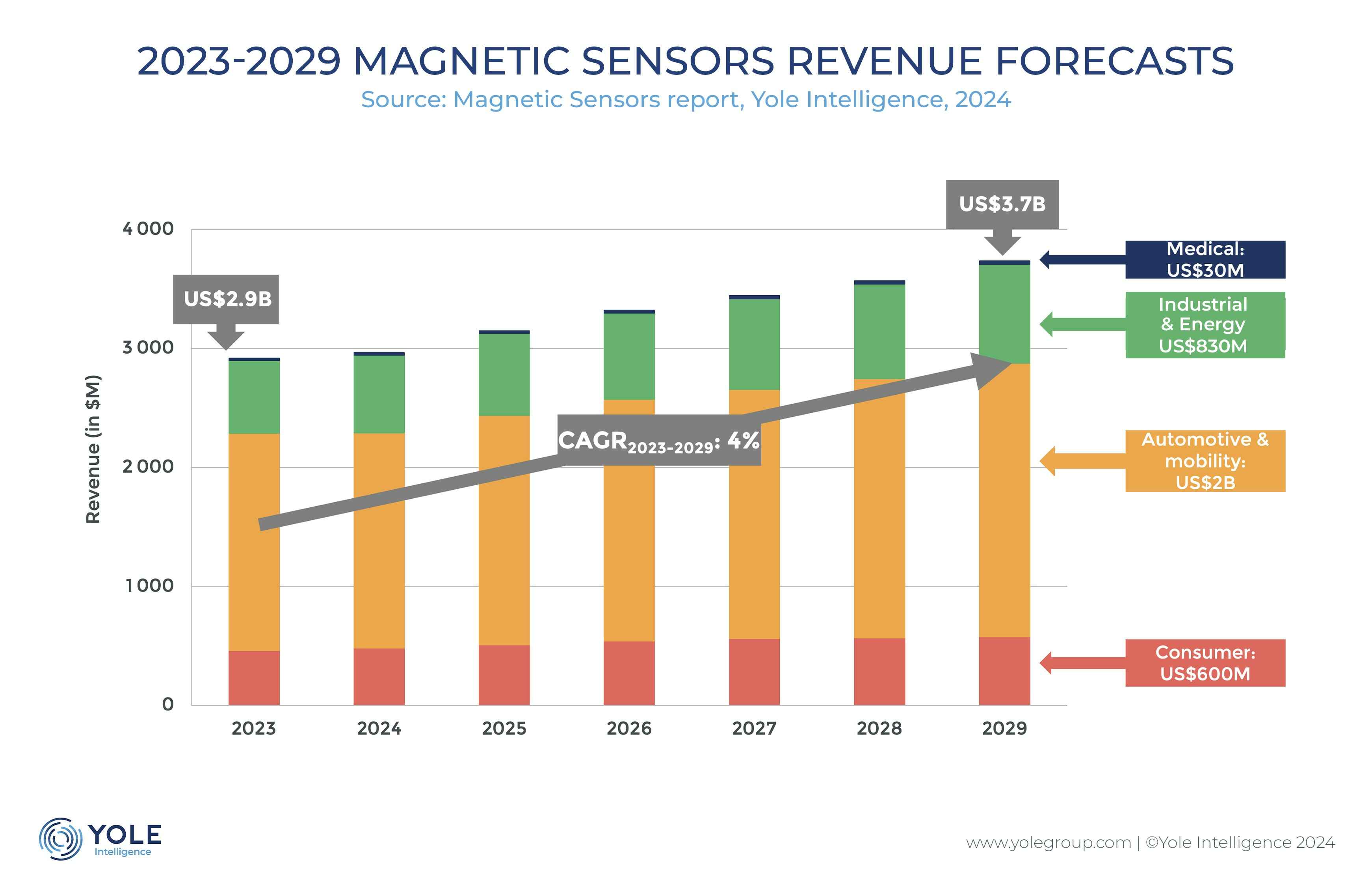

The magnetic sensor market is expected to reach $3.7 billion in 2029, with an estimated 4% CAGR from 2023 to 2029, says Yole Developpement.

RECOMMENDED ARTICLESHBM to be 14% of DRAM industry this yearUS strategy for microelectronics research publishedTelecom equipment sales fell 5% in 2023, set to fall again in 2024Smartphones bounce backAllegro Microsystems leads in revenue, TDK leads in volume.

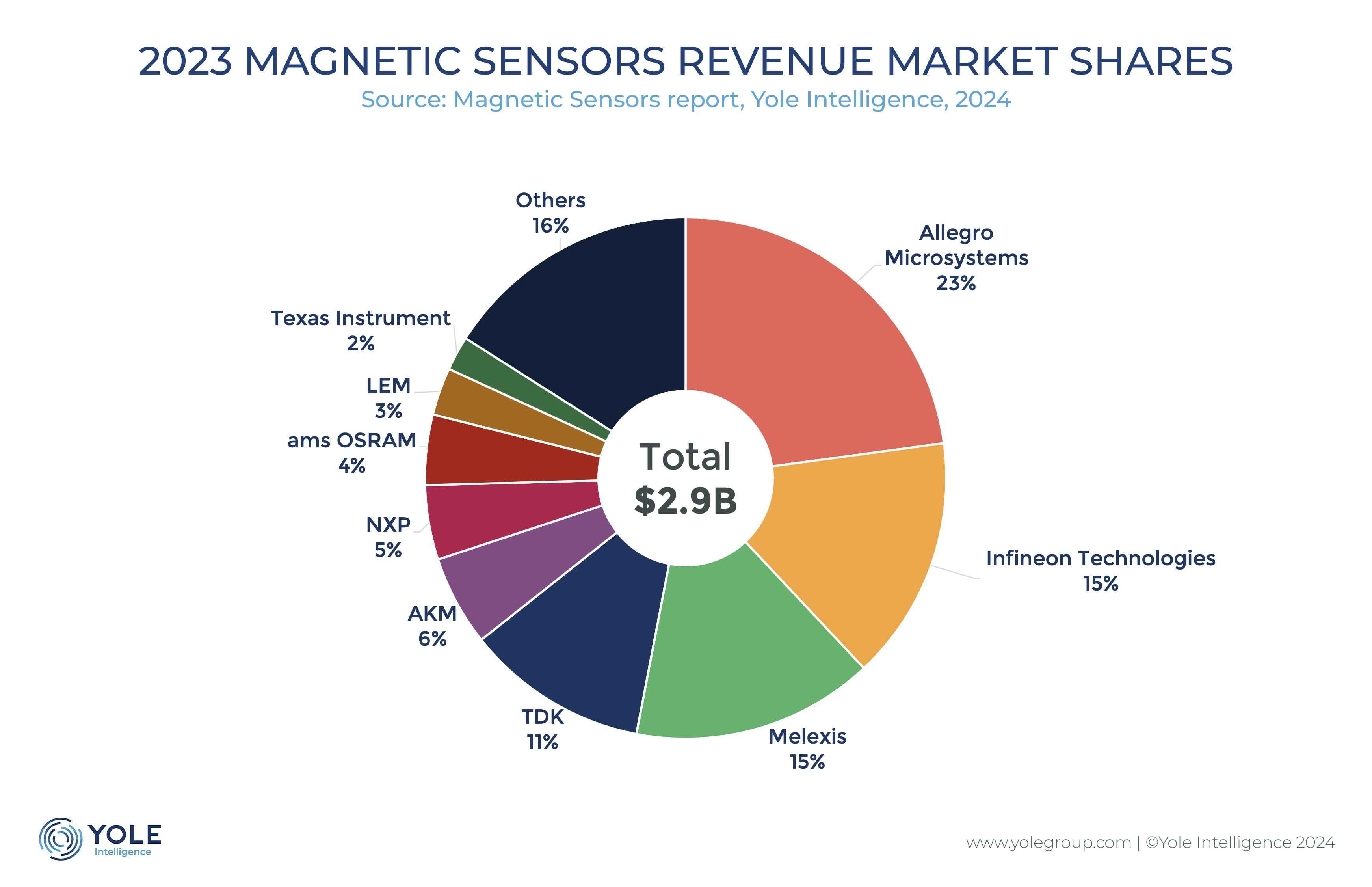

A $1 billion investment surge from players like Allegro, TDK, Bosch, LEM etc. is leveraging the technology’s sensitivity, bandwidth, and low power consumption to sense position and current.

Magnetic sensors find widespread application across automotive, mobility, industrial, energy, medical, and consumer sectors. Their versatility has led to their adoption in various fields, propelling the market to a value of $2.9 billion in 2023.

“The automotive & mobility segment significantly dominates the market with sales of more than $2 billion by 2029,” says Yole’s Pierre Delbos, “this segment is driven by important shifts such as vehicle electrification and sensor integration. Conversely, consumer applications lead in terms of volume. At Yole Group, we anticipate a nearly $600 million market by 2029, also growing at a 4% CAGR between 2023 and 2029”.

The evolving landscape of magnetic sensor applications extends to the industrial & energy and medical sectors. By 2029, these sectors are expected to reach $830 million and $30 million, respectively.

Factors such as the proliferation of DC-charging stations with integrated current sensors due to vehicle electrification, the demand for position sensors, switches, and latches driven by Industry 4.0, and the potential implementation of predictive maintenance using current sensors contribute to the promising outlook in these sectors.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr