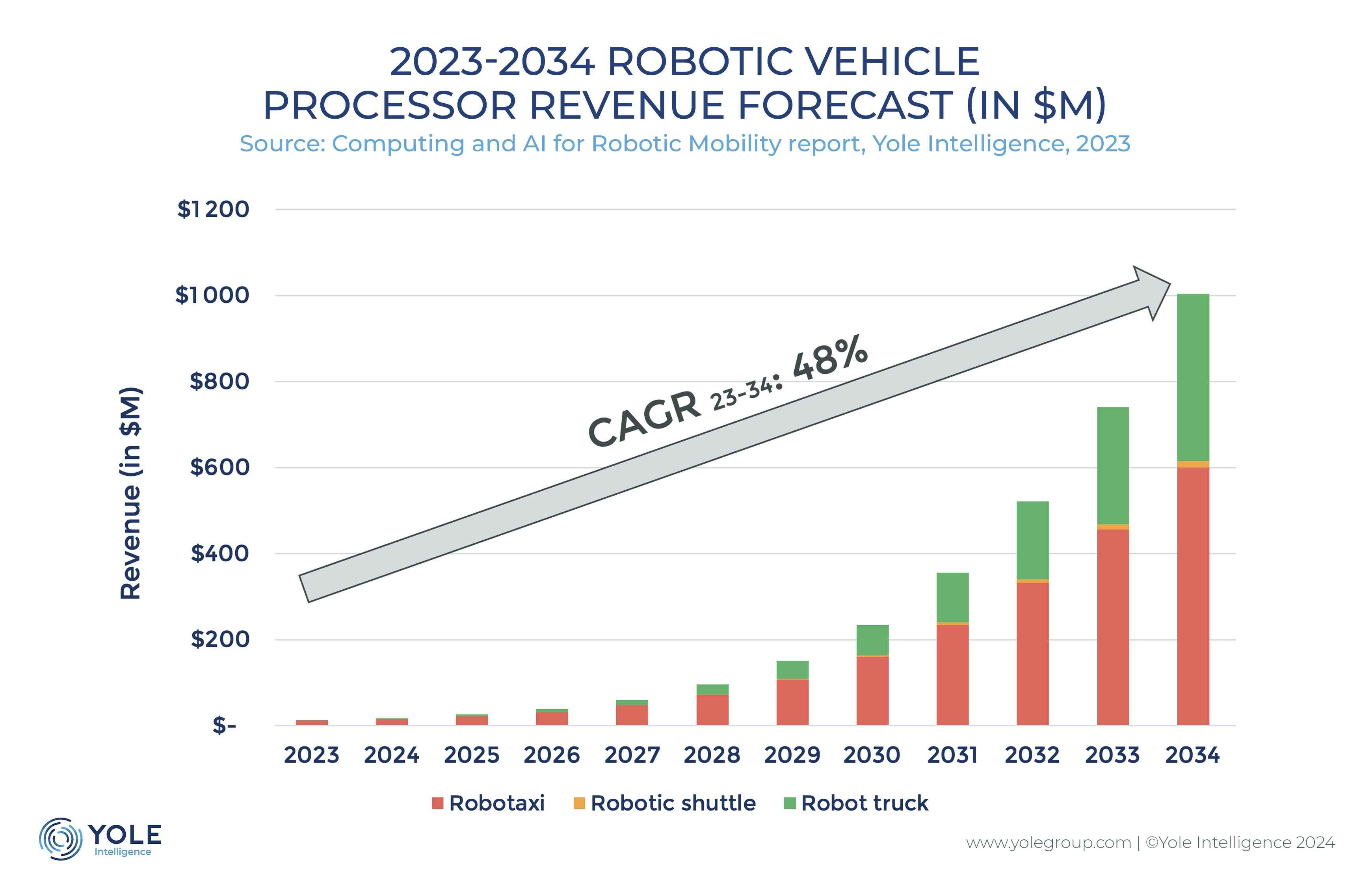

Over the past nine years, the global investment in robotaxis, robot shuttles, and robot trucks has reached nearly $42.5 billion, says Yole Developpement, with the robotic vehicle processor market expected to reach $1 billion in 2034, with an estimated 48% CAGR from 2023 to 2034.

The expanding robotaxi market will see a division between processors tailored for automotive use and those specifically designed for the purpose.

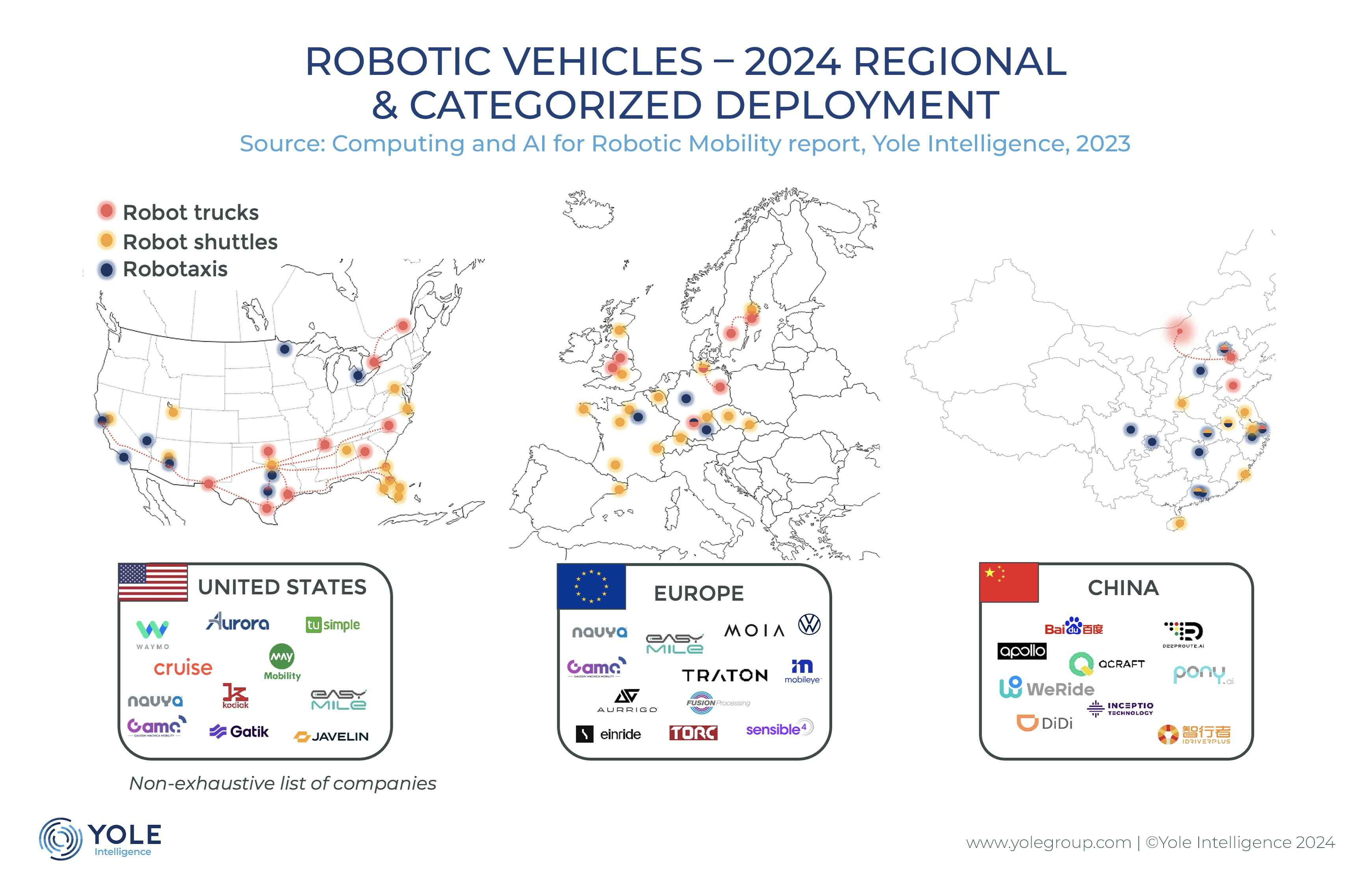

Robotaxis and robot trucks are dominated by the US and China, with Europe trailing behind in robot shuttles.

Essential for achieving autonomy, robotic vehicle processors demand significant computing power for instantaneous decision-making.

Initially, server/PC-grade processors were employed due to their robust computing capabilities.

However, with advancements in the automotive processor market, those tailored for ADAS /AD functions have emerged as more cost-effective and energy-efficient alternatives for robotic vehicles.

“Nvidia, an early player, introduced high-performance processors with the Parker architecture in 2016, now widely utilised in numerous robotic vehicles,” says Yole’s Adrien Sanchez, “however, competition has intensified with the development of ADAS/AD processors, gaining momentum from companies like Mobileye, Qualcomm, and Huawei. Notably, startups such as Horizon Robotic and Black Sesame provide potential solutions, particularly for Chinese companies aiming for secure domestic supply chains.”

On the architectural front, diverse solutions are emerging. Mobileye, for instance, has pioneered a scalable processor family, departing from a fully centralized architecture based on a single processor.

This approach not only reduces development costs but also provides a flexible solution tailored to the specific needs of its customers.

Simultaneously, a prevailing trend among leaders in the robotic industry involves the in-house development of custom processors to precisely address specific requirements.

“The global landscape for robotic vehicles is characterized by three key regions: the United States, China, and Europe,” says Yole’s Hugo Antoine, “in the U.S, active testing of autonomous vehicles is underway, with robotaxi services already available in a few cities, and rapid progress in the deployment of robot trucks connecting the East Coast to the West Coast,”

China has asserted itself as a frontrunner in autonomous technology, with Baidu-Apollo leading in robotaxi and shuttle services, closely followed by dynamic companies like WeRide and Pony.ai.

Europe, too, is actively involved, particularly in robot shuttle companies and testing initiatives.

The Middle East, notably the UAE and KSA, is actively participating in robotic mobility projects through strategic partnerships with European, Chinese, and American companies.

In the autonomous vehicle industry, companies focusing on robotic vehicles initially prioritise their core segments to manage costs and enhance scalability.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr