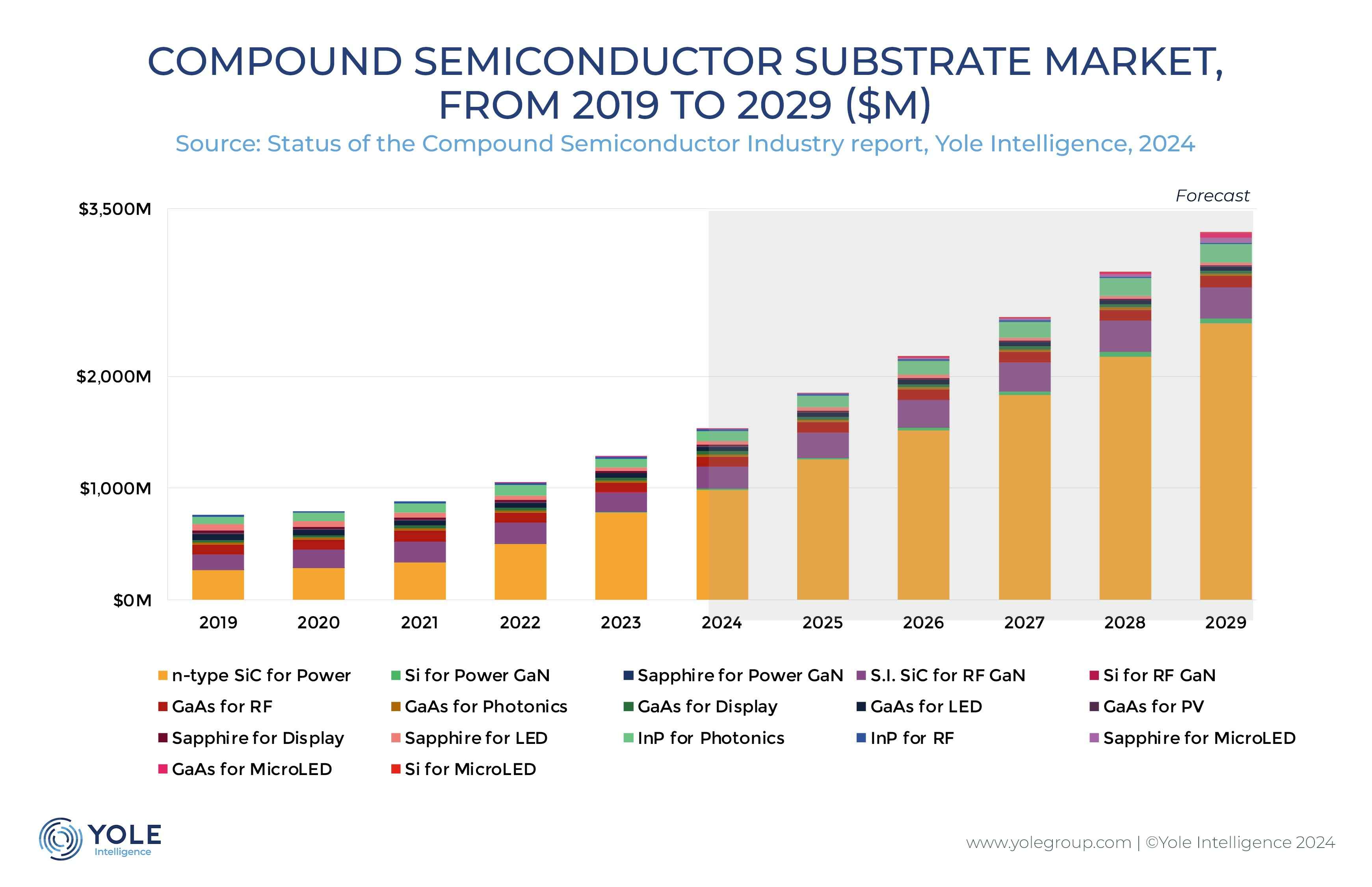

The compound semiconductor substrate market is expected to reach $3.3 billion in 2029, with a 17% CAGR between 2023 and 2029, says Yole Developpement.

Substrate players consistently craft new strategies to diversify their product portfolios and enhance their market presence.

Compound semiconductor technologies showcase diverse advancements across sectors:leg. SiC , GaN , InP and. have emerged as a transformative influence across various industries.

SiC’s dominance in the automotive sector, especially in the domain of 800V EVs , drives a billion-dollar market, while GaN power electronics is expanding its presence in both the consumer and automotive fields.

Yole expects a billion-unit opportunity in smartphone OVP (Over Voltage Protection) . In anticipation of a resurgence, RF GaAs aligns itself with 5G and automotive connectivity, while RF GaN establishes its presence in defense, telecommunications, and space industries, targeting high-power applications.

Within the realm of photonics, InP and GaAs take the lead, with InP experiencing a resurgence fueled by AI applications, while GaAs photonics sees more modest growth influenced by various market dynamics. Although MicroLEDs show potential, their widespread adoption is gradual,

“The CS industry is at the corner to transition to larger diameter substrates. In the Photonics sector,” saysYole’s Ali Jaffal, “AI is driving the demand of high-data-rate lasers, which could accelerate the transition to 6” InP substrates.

On the other side of the coin, GaAs explores 8” manufacturing for microLED, which is competing with OLED, facing yield and efficiency challenges, questioning its success but gaining momentum with substantial investments.”

Suppliers of GaAs and InP substrates, including Freiberger, Sumitomo Electric, and AXT, play a central role in the transition to larger diameter substrates. Photonics is part of this story, and the Power and RF markets further complement this narrative.

Wolfspeed is leading the change to supply SiC substrates for power electronics applications. It has recently transitioned to the larger 8” wafer fabs and is expanding its material capacity in line with its strategic vision.

Coherent, another leading player, focuses on photonic devices and dominates the SiC substrate market for both power and RF applications. It has made a number of strategic alliances, for example, with SEDI in RF GaN, to reinforce its position and has started supplying power SiC devices. Following these actions, it covers the whole value chain from substrates to advanced devices.

The landscape is continuously evolving, with multiple innovations on many fronts and strategic partnerships.

“Compound semiconductor technologies are advancing across sectors, notably in the booming SiC industry “ says Yole’s Taha Ayari “while 6” wafers are still standard, Wolfspeed’s $1.2 billion investment in MHV fab is pioneering the transition to 8″ wafer size. Other efforts focus on improving SiC wafer yield and supply, with innovations like engineered substrates from Soitec and Sumitomo Mining. Power GaN sees a shift to 8-inch GaN-on-Si, driven by expansion at Innoscience, STMicroelectronics, and Infineon Technologies”.

“RF GaN-on-Si is benefiting from synergies with the relatively more mature Power GaN to enter the telecom market and compete with established RF GaN-on-SiC technology,” says Yole’s Aymen Ghorbel, additionally, major changes in the RF GaN ecosystem, such as Wolfspeed RF business being acquired by Macom, could impact the RF GaN industry”.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr