Q4 is expected to see a further 5–10% QoQ increase in production.

The downturn in global smartphone production for 2023 is expected to be limited to less than 3%, with total annual output estimated to reach approximately 1.16 billion units.

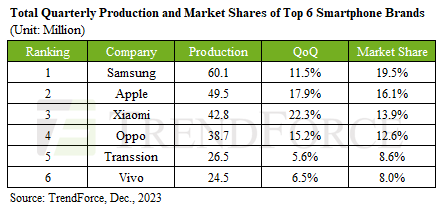

Samsung continues to lead the market after recording an 11.5% increase in its Q3 production at 60.1 million units – only 5 million more than apple.

Apple saw its Q3 production climb 17.9% to reach approximately 49.5 million units. However, it had a 1.5% YoY market share decline, with annual production at 2022 levels.

Huawei’s re-entry with its flagship phones is anticipated to significantly impact Apple’s production performance in the upcoming year.

Xiaomi (including Xiaomi, Redmi, and POCO) saw Q3 production jump by 22.3% to approximately 42.8 million units.

Oppo (including Oppo, Realme, and OnePlus) experienced a 15.2% increase in its Q3 output to 38.7 million units.

Transsion (including TECNO, Infinix, and itel) produced 26.5 million units—a 5.6% increase QoQ.

Vivo (including Vivo and iQoo) saw its Q3 production rise to 24.5 million units, marking a 6.5% increase and placing it in the sixth spot.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr