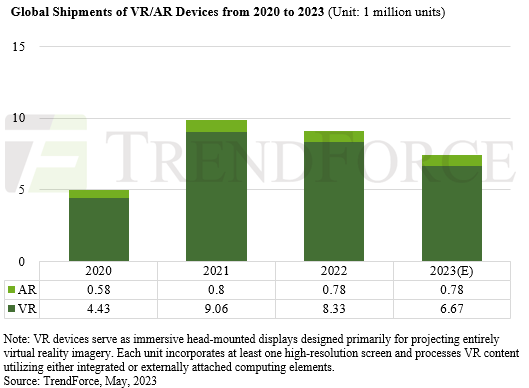

AR unit shipments will stay stable at 780,000 units.

The predicted fall for VR units is because of weaker-than-expected sales of newly released high-end devices.

Consequently, manufacturers are likely to pivot their sales strategies, shifting their focus to more cost-effective offerings.

While Apple’s latest offerings could stimulate some demand, the high price tags attached to these units continue to pose a significant barrier to broader market growth.

MetaQuest 2 continues to maintain its status as this year’s market-leading VR product as the release of Meta Quest 3 has been pushed back to 2024.

Although Apple is projected to launch a new product in 2023, this release is primarily targeted at developers, signifying an accompanying escalation in specifications, features, and, most importantly, cost.

TrendForce anticipates that a significant rise in the VR and AR market, potentially nearing a 40% annual increase in shipments, might not be realized until 2025

IDC reckons the 2023 European AR/VR market will be worth $1.1 billion and $3.4 billion respectively rising, by 2027, to a collective $10.5 billion, with a 2022-6 CAGR of 24.9%.

Source: Electronics Weekly

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr