Semiconductor industry watchers say the memory market has entered a prolonged upcycle, with DRAM and NAND likely to remain in short supply until at least 2028.

Historically, memory suppliers have veered between over and undersupply, swinging from periods of high demand and shortages to downturns marked by excess inventory, profit booms and busts, and supply gluts followed by droughts. This time, however, demand driven by AI training and inference workloads is reshaping the cycle. The surge in memory requirements is so strong that it will take years for manufacturers to expand capacity enough to catch up.

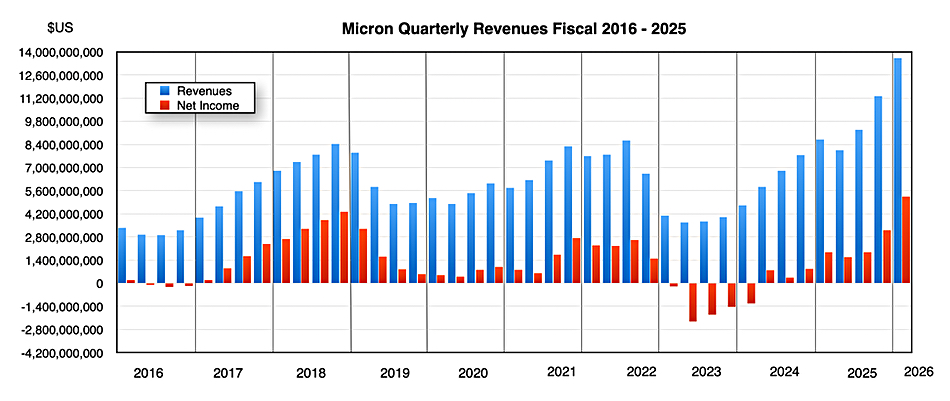

A look at Micron’s revenue and profit from its memory products illustrates the traditional glut-to-drought pattern:

Demand rose sharply from 2016 to 2018, fell into a trough in 2019 and 2020, climbed again in 2021 and 2022, and then dipped once more in 2023. Since then, demand has surged through 2024 and 2025, with no sign of easing as 2026 begins.

When Micron published its fiscal 2026 Q1 results in December, it said sustained industry demand combined with supply constraints was creating tight market conditions, which it expected to persist beyond calendar 2026. That implies an upcycle lasting at least three years, and potentially longer.

A major driver is high-bandwidth memory (HBM) used in GPUs for AI training and inference. Hyperscale GPU compute suppliers are consuming increasing volumes of HBM, and Micron forecasts the HBM total addressable market will grow at a compound annual rate of about 40 percent through calendar 2028, rising from roughly $35 billion in 2025 to around $100 billion in 2028.

NAND demand for AI workloads tends to follow HBM growth, suggesting the current upcycle could run from 2024 through 2028.

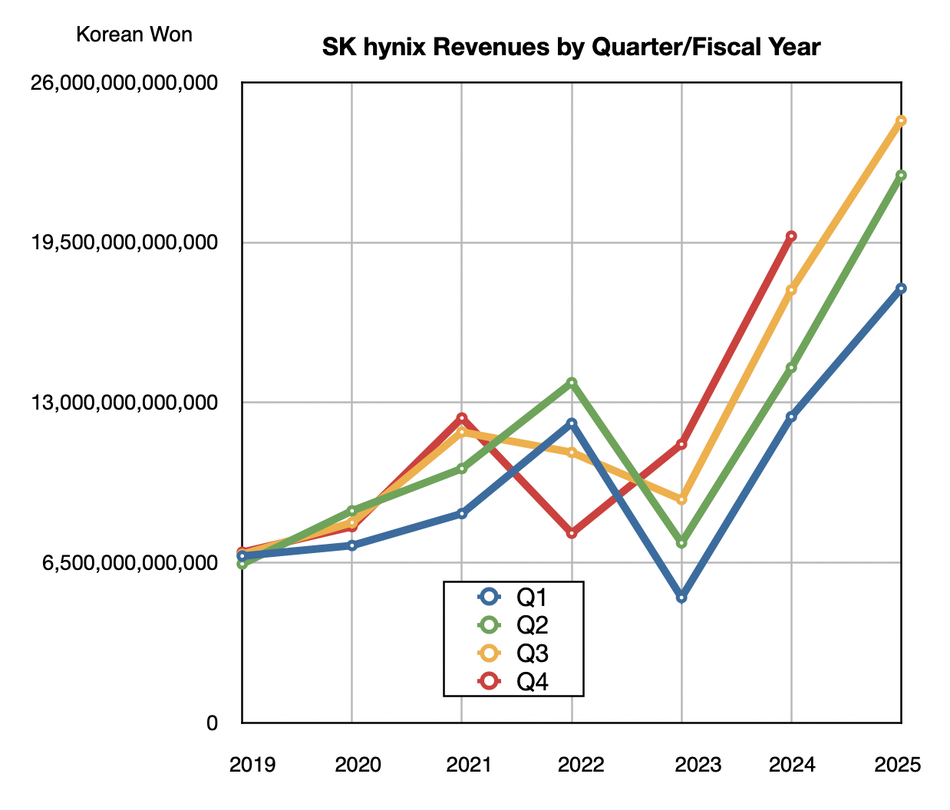

Micron is not alone in seeing this pattern. SK hynix’s quarterly revenue history since 2016 shows two relatively modest demand cycles followed by a much stronger upswing in recent years.

The Bloomsbury Intelligence and Security Institute points out: “The global memory market is experiencing a structural crisis, driven by manufacturers reallocating wafer capacity from commodity Dynamic Random Access Memory (DRAM) to High-Bandwidth Memory (HBM) for Artificial Intelligence (AI) applications. As a result, DRAM prices have risen 171 percent year-over-year, and DDR5 spot prices have quadrupled since September 2025.”

How long will this last? “Memory prices are likely to remain elevated through 2027-2028, with partial normalisation a realistic possibility only when new fabrication facilities reach volume production; an oversupply scenario in 2028-2029 remains a realistic possibility if AI demand moderates as capacity expands.”

Industry analyst firm IDC also characterizes the situation as a semiconductor supercycle, saying: “Long-term semiconductor revenue growth remains on track for a double-digit CAGR for 2024-2028, after the 2023 correction and 2024 recovery.”

For the storage industry, the impact is higher NAND costs and longer delivery times. Vendors are already responding with strategies such as VAST’s Flash Reclaim approach and VDURA’s emphasis on tiering data from solid-state drives to hard disks to reduce SSD requirements.

We expect hybrid flash-and-disk storage suppliers to push similar messaging, alongside data management vendors promoting techniques to move non-critical data off SSDs and apply data reduction to fit more information into less NAND. There is no simple fix for the underlying supply constraints; at best, the industry can focus on making the situation less bad.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr