GlobalFoundries forecasts stronger results for the fourth quarter of 2025, saying robust demand from automotive and data center customers is expected to offset continued weakness in the smartphone market.

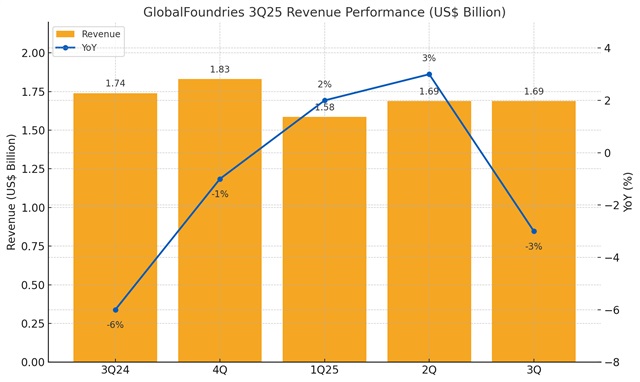

The company reported third-quarter 2025 revenue of US$1.69 billion, down 3% from a year earlier, while net income rose 40% to US$250 million. GlobalFoundries expects fourth-quarter 2025 revenue to reach about US$1.8 billion, saying orders from carmakers and data center clients remain solid. Analysts expect the chipmaker to regain growth momentum in 2026.

According to Reuters and Barron's, demand for GlobalFoundries' customized chips has increased as automakers invest more heavily in electric vehicles and advanced driver-assistance systems. Technology companies are also expanding data center capacity to support the rapid deployment of artificial intelligence models.

Strong segments, weak mobile

Automotive and communications infrastructure and data center chips were the strongest contributors in the third quarter of 2025. Automotive revenue grew 20% to US$306 million, while communications infrastructure and data center revenue rose 32% to US$175 million.

However, revenue from smart mobile devices and home and industrial IoT customers declined sharply. Smart mobile device revenue fell 13% to US$752 million, while home and industrial IoT revenue dropped 16% to US$258 million.

Smartphone-related chip sales once again missed market expectations. Automotive has now become the company's second-largest end market, although its performance still came in below forecasts.

Growth comparisons toughen

Stronger results from communications infrastructure and data center customers helped make up for the weakness. Compared with peers such as Broadcom, GlobalFoundries has benefited less directly from the AI boom.

Analysts said the company faces tougher growth comparisons over the coming year. Revenue from automotive and data center customers grew sharply in the fourth quarter of 2024, and year-over-year growth has since moderated. The market expects GlobalFoundries to return to growth in 2026 even if that rebound does not happen this quarter.

TSMC licensing deal

GlobalFoundries said on November 10, 2025, that it has signed a licensing agreement with TSMC for 650-volt and 80-volt gallium nitride technology.

The deal is intended to accelerate the development of next-generation GaN products for data center, industrial, and automotive power applications and provide global customers with US-based GaN manufacturing capacity.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr