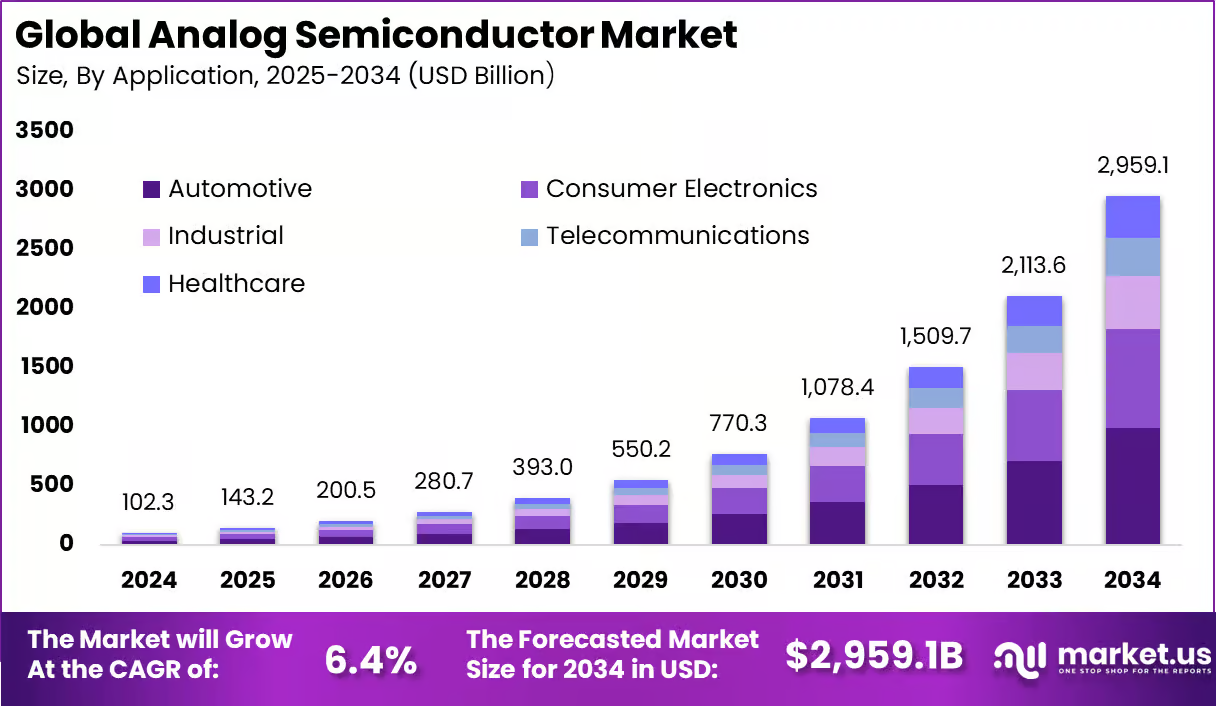

The market size of analog semiconductors was recorded at USD 102.3 billion in 2024 and is projected to register consistent expansion, rising from USD 143.2 billion in 2025 to approximately USD 2,959.1 billion by 2034, growing at a CAGR of 6.4%. In 2024, Asia-Pacific held a dominan market position, capturing more than a 45.9% share, holding USD 46.9 Billion revenue.

The analog semiconductors market consists of integrated circuits and devices that process real-world signals (voltages, currents, frequency, temperature, light, etc.) rather than purely logic or digital signals. These components include operational amplifiers, data converters (ADCs, DACs), power management ICs, voltage regulators, RF amplifiers, analog switches, and interface circuits. Many analog parts are integrated with digital circuits in mixed-signal ICs for sensors, communications, and control systems.

Top driving factors for the analog semiconductors market include the rapid expansion of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). Analog components are vital for battery management, motor control, and sensor systems in EVs. The rising registrations of electric cars, which reached around 14 million globally by 2023, significantly fuel demand.

According to Market.us, The Global Semiconductor Market was valued at USD 840.6 billion in 2024 and is forecasted to grow from USD 907.4 billion in 2025 to about USD 2,010.6 billion by 2034, expanding at a CAGR of 9.20% between 2025 and 2034. In 2024, APAC dominated the market with over 65.7% share, generating USD 552.2 billion in revenue.

Additionally, the growth of IoT ecosystems, encompassing smart homes, industrial automation, and smart cities, depends heavily on analog chips for signal processing and power efficiency. The deployment of 5G networks further intensifies demand for high-performance analog semiconductors due to their role in high-frequency signal transmission and low-latency communication. These factors, combined, create a synergistic effect driving the market upward.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr