The global semiconductor industry is undergoing a seismic shift, driven by the explosive growth of artificial intelligence (AI) infrastructure. By 2025, the semiconductor market is projected to reach $700.9 billion, with AI-related chips accounting for over $150 billion in sales alone. This represents a 11.2% year-over-year increase, fueled by surging demand for GPUs, CPUs, high-bandwidth memory (HBM), and advanced packaging technologies. As the industry races toward a $1 trillion valuation by 2030, investors must strategically position themselves in the AI semiconductor ecosystem to capitalize on this unprecedented growth.

The AI Semiconductor Boom: A $459 Billion Future

The AI-specific semiconductor market is already a $83.8 billion juggernaut in 2025, with a projected compound annual growth rate (CAGR) of 27.5% to reach $459 billion by 2032. This growth is underpinned by the proliferation of generative AI, which is expected to dominate 20% of total chip sales in 2024 and surge to $150 billion in 2025. Key drivers include the adoption of AI accelerators in data centers, edge computing, and consumer devices, with GPUs and TPUs leading the charge.

For investors, the CPU segment currently holds a 39.0% market share in AI chips, while the machine learning segment accounts for 36.0%. However, the real opportunity lies in the rapid scaling of specialized AI hardware. Companies like NVIDIA, AMD, and Broadcom are already reaping the rewards of this shift, with NVIDIA’s H100 GPU and AMD’s Instinct series becoming cornerstones of AI infrastructure.

Regional Dynamics and Foundry Dominance

The Asia-Pacific region is emerging as the epicenter of AI semiconductor innovation. China, South Korea, and Taiwan are prioritizing domestic AI chip development through government initiatives, reducing reliance on foreign technology.TSMC, the world’s largest foundry, is poised to dominate this landscape, with its market share expected to rise from 59% in 2023 to 66% in 2025. TSMC’s CoWoS advanced packaging technology, which enables high-performance computing (HPC) for AI, is a critical differentiator. Production capacity for CoWoS is set to double in 2025, driven by demand from NVIDIA, AMD, and AWS.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

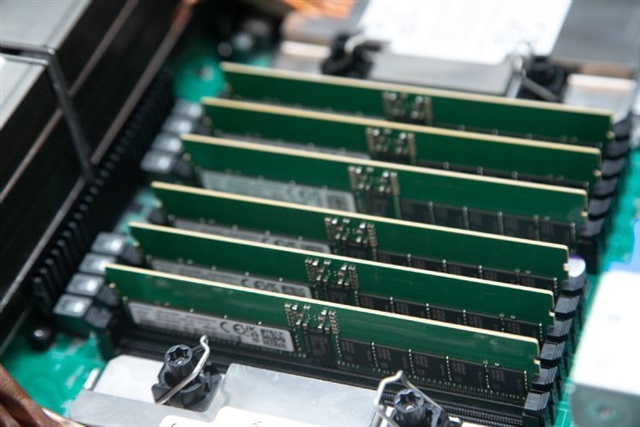

hina's National Development and Reform Commission (NDRC) has issued a rare monitoring report warning that rising memory prices are spreading across the electronics supply chain as tight supply and

Nvidia strengthened its dominance in the add-in-board (AIB) GPU market in the fourth quarter of 2025, capturing a record 94% market share even as overall shipments dipped amid rising memory prices and

Broadcom shares rose sharply in aftermarket trade on Wednesday after the artificial intelligence chips maker delivered a quarterly top and bottom-line beat and provided current quarter revenue guidanc