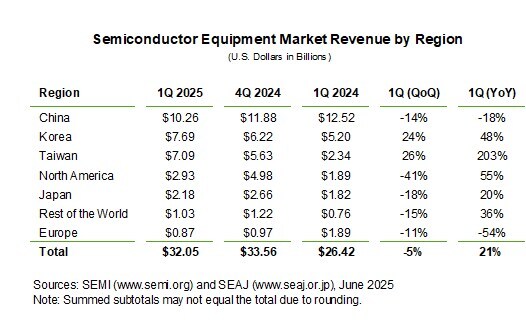

SEMI, the industry association serving the global semiconductor and electronics design and manufacturing supply chain, today reported in its Worldwide Semiconductor Equipment Market Statistics (WWSEMS) Report that global semiconductor equipment billings increased 21% year-over-year to US$32.05 billion in the first quarter of 2025. In line with typical seasonality, first-quarter 2025 billings registered a 5% quarter-over-quarter contraction.

"The global semiconductor equipment market began 2025 with a solid quarter that reflects future-looking investments in vital chipmaking capacity across regions," said Ajit Manocha, SEMI President and CEO. "With the ongoing AI boom continuing to drive fab expansions and equipment sales, the industry is showing resilience in the face of uncertainty around geopolitical tensions, tariff volatility and export controls. SEMI is actively engaging with governments to advocate for policy stability essential to multi-billion-dollar fab investments, including equipment, and the long-term success of advanced manufacturing operations."

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr