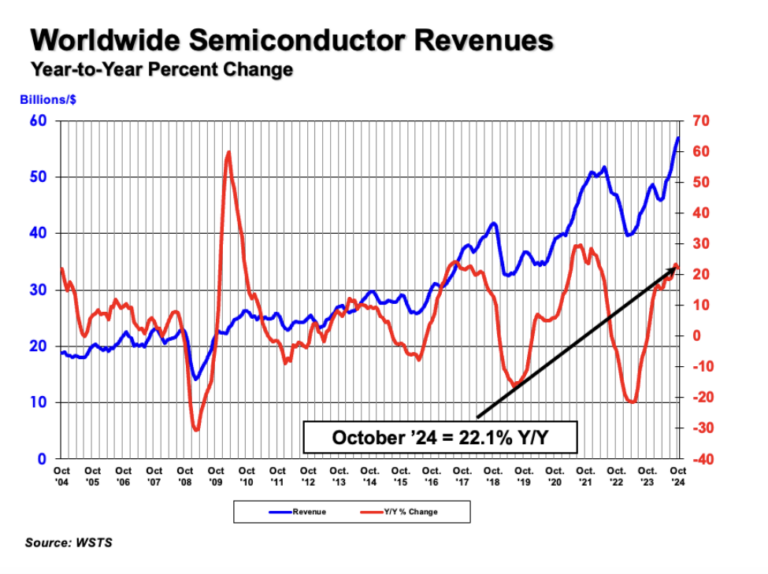

The Semiconductor Industry Association (SIA) today announced global semiconductor sales hit $56.9 billion during the month of October 2024, an increase of 22.1% compared to the October 2023 total of $46.6 billion and 2.8% more than the September 2024 total of $55.3 billion. Monthly sales are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average. SIA represents 99% of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip firms.

Additionally, a new WSTS industry forecast—endorsed by SIA—has been revised upward for 2024. It now projects annual global sales will increase 19.0% year-to-year, reaching a sales total of $626.9 billion this year. In 2025, global sales are projected to reach $697.2 billion, a year-to-year increase of 11.2%. WSTS tabulates its semi-annual industry forecast by gathering input from an extensive group of global semiconductor companies that provide accurate and timely indicators of semiconductor trends.

“The global semiconductor market is closing out 2024 on a high note, as the industry reached its highest-ever monthly sales total in October and month-to-month sales increased for the seventh consecutive month,” said John Neuffer, SIA president and CEO. “Total annual sales are now projected to increase by nearly 20% in 2024—higher than earlier forecasts—and then continue to grow by double-digits in 2025.”

Regionally, year-to-year sales in October were up in the Americas (54.0%), China (17.0%), Asia Pacific/All Other (12.1%), and Japan (7.4%), but down in Europe (-7.0%). Month-to-month sales in October increased in the Americas (8.3%), Europe (1.3%), China (1.0%), and Japan (0.2%), but decreased slightly in Asia Pacific/All Other (-0.7%).

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr