ASML Holding NV Chief Executive Officer Christophe Fouquet said he expects the chip market’s long-awaited recovery will extend “well into 2025,” following disappointing third-quarter earnings that sparked a broad selloff across the semiconductor industry.

Slow recovery in demand has led to “customer cautiousness and some push-outs in their investments,” Fouquet said in a call with investors on Wednesday. That’s led ASML to slash its earnings guidance, even as Fouquet said the artificial intelligence boom, energy transition and electrification continue to provide strong upside.

Fouquet, who took the helm at ASML in April, is facing one of the most tumultuous periods in the company’s history. The Dutch company, which makes the world’s most advanced chipmaking machines, has shed over €60 billion ($65 billion) in value since it reported bookings that were less than half of what analysts expected on Tuesday.

ASML is a bellwether for the wider chip industry, and Fouquet’s comments were a clear indicator that the AI boom isn’t a panacea for the sector’s woes. It has a monopoly on making the machines that help companies like Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. produce the most advanced chips that power everything from Apple Inc.’s smartphones to Nvidia Corp.’s AI accelerators.

“Today, without AI, the market would be very sad, if you ask me,” Fouquet said. “The recovery is not what I think everyone had wished for.”

Fouquet said demand recovery in the automotive, mobile and PC markets has been particularly slow, even while AI-related server demand is robust. The Dutch company will slow its short-term investment plans to match the market, he added.

Pushed Back

Some orders that were scheduled for 2025 have been pushed back to 2026, Chief Financial Officer Roger Dassen said on the call.

ASML cut its outlook for next year, triggering a 16% decline in its share price on Tuesday in Amsterdam, the biggest since June 12, 1998. On Wednesday, it fell 5.1% and surrendered its place as Europe’s most valuable technology company to software firm SAP SE. It has lost about a quarter of its value since Fouquet took over.

The weak results were amplified by the company mistakenly releasing its financial results a day earlier than scheduled. Fouquet apologized for the premature publication of the release, which was expected on Wednesday.

“This was very unfortunate,” he said, attributing the issue to a “technical error.”

ASML is facing pressure from multiple directions. While demand for the chips that power AI data centers remains strong, key customers including Intel Corp. and Samsung are struggling.

Intel, faced with shrinking sales and mounting losses, last month delayed new factories planned in Germany and Poland. Samsung issued an apology to investors this month for disappointing results after delays let competitors dominate the market for high-bandwidth memory chips used in AI.

Companies producing automotive and industrial chips, which often use ASML’s less advanced machinery, are also in a prolonged slump because their clients have too much inventory.

Apple shares slipped 1.5% on Wednesday. Analysts have said preliminary data on preorders and lead times for the iPhone 16 suggest tepid demand.

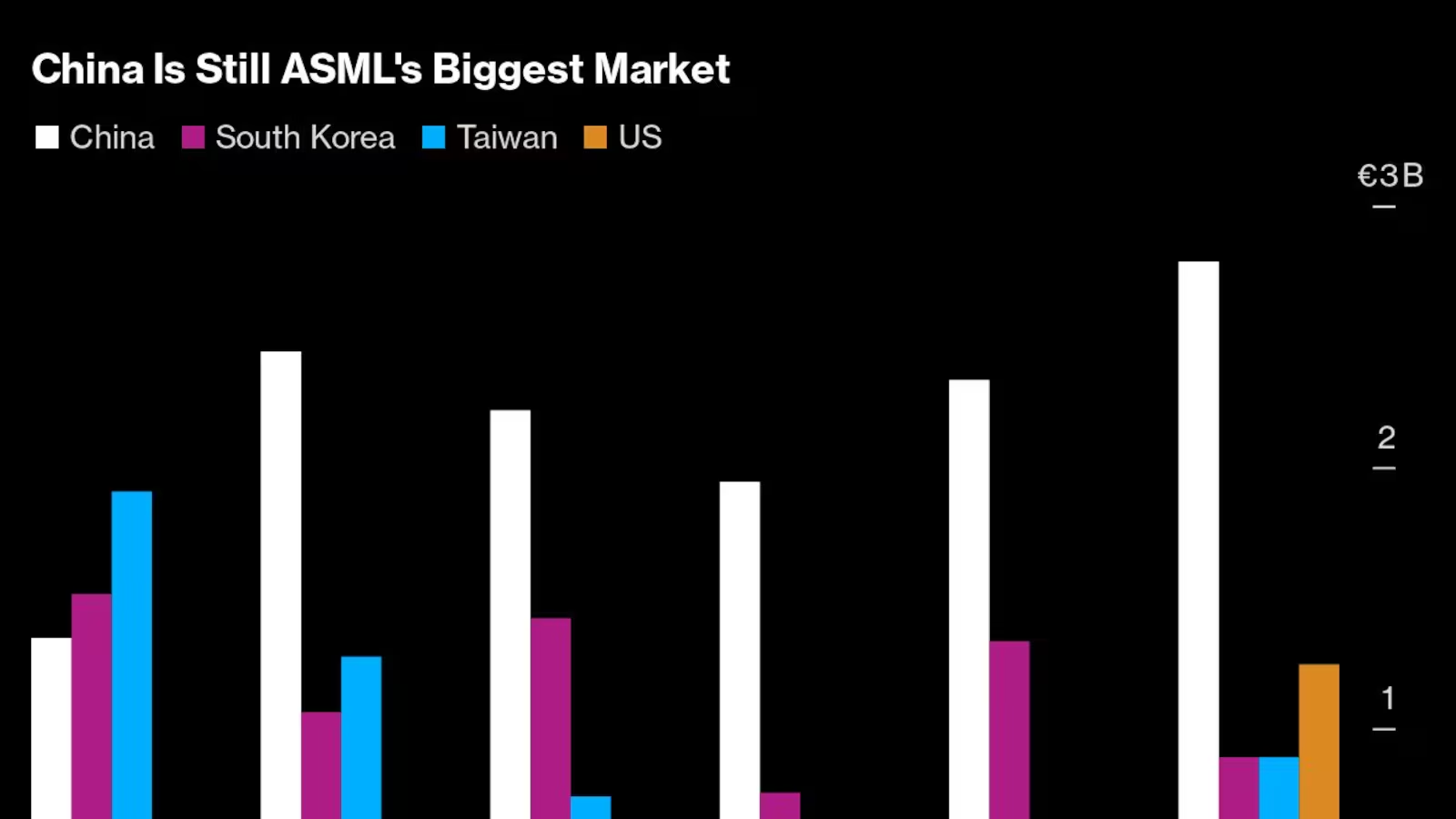

China Sales

Meanwhile, the US and its allies are ratcheting up pressure on China, ASML’s biggest market for the last five quarters, as Washington seeks to limit access to cutting-edge chip technology. China accounted for €2.79 billion of sales in the third quarter, nearly half of ASML’s total.

Dassen said the company expects China sales to account for about 20% of total revenue next year, adding that this level is a “normal percentage” for that market.

Analysts on the call repeatedly pressed management for details on ASML’s outlook for China, which Dassen said is expected to account for about 20% of total revenue next year.

“The 20% is what we consider to be a normal percentage of our business for China,” Fouquet said. “So we would assume that is a number that also on a go forward basis, we believe would be realistic for China. Of course, subject to, to anything related to export controls.”

Last month, the Netherlands published new export control rules that made ASML apply for export licenses in The Hague instead of US for some of its older machines. That came after a Bloomberg News report that the Dutch government would limit some of ASML’s ability to repair and maintain its semiconductor equipment in China.

“We read newspapers, and we read continued speculation on things that might happen,” Dassen said. “And as a result of that, we’ve decided to take a more cautious view” on China, he added.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr