The automotive processor market generated $20 billion in revenues last year with $7.8 billion from APUs (Application Processing Units) and FPGAs, and$12.2 billion from MCUs, according to Yole Group.

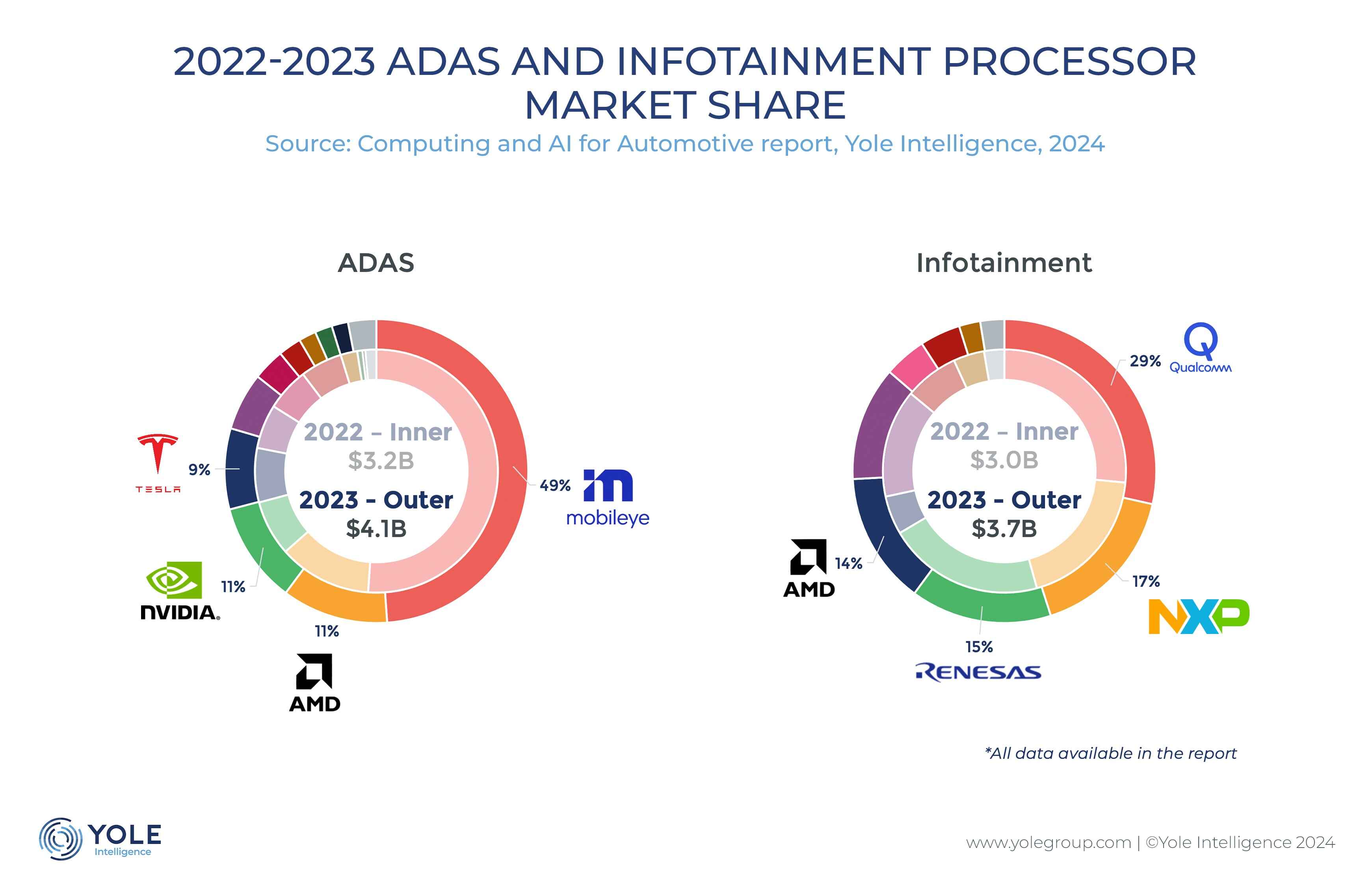

APU and FPGA processors were divided between ADAS with $4.1 billion, and cockpit applications with $3.7 billion.

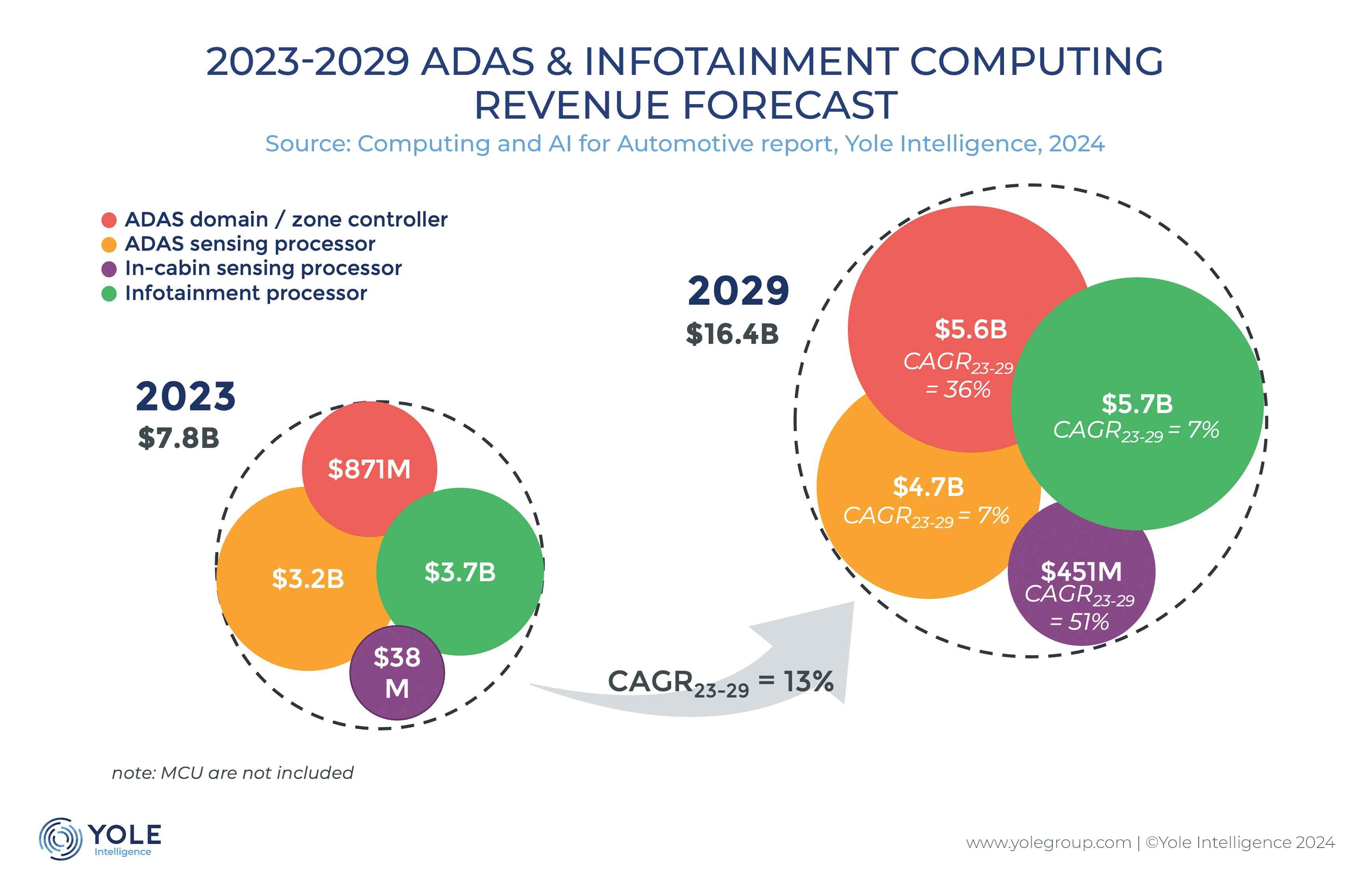

ADAS and active safety applications are projected to grow robustly, while infotainment and telematics applications are expected to grow at a CAGR of 8% to $5.9 billion by 2029.

The market for ADAS sensing, including imaging processors for front-facing cameras, radar APUs, and LiDAR processors is expected, at a 7% CAGR23-29.

Central computing within vehicles is projected to experience a surge with a 36% CAGR23-29, propelled by the increasing integration of ADAS domain controllers.

Additionally, in-cabin sensing technologies, focused on monitoring driver and occupant behavior, are set to grow rapidly, reflecting a shift toward enhanced in-vehicle safety and user experience.

“In the infotainment and telematics segment, the primary in-vehicle infotainment unit is projected to grow steadily, with telematic processors expected to see substantial growth, particularly with the rollout of 5G technology,” says Yole’s Adrien Sanchez, “this points to a future where connected and intelligent vehicles become increasingly commonplace, driven by the continuous evolution of automotive processor technologies.”

AD central processors are anticipated to grow from $826 million in 2023 to $4.4 billion by 2029 at a 32% CAGR. VPUs (Vision Processing Units), APUs, and FPGAs are expected to grow with CAGRs of 4%, 53%, and 20%, respectively.

The Computing and AI for Automotive report from Yole Group provides an overview of computing for safety, ADAS and AD, in-cabin sensing, cockpit, and connectivity applications.

This report provides a potential scenario for AI evolution within the dynamics of the autonomous automotive market and presents an understanding of the impact of AI on the semiconductor industry.

The growing importance of processors in the automotive industry, coupled with the complexity of these systems, has prompted OEMs to become more involved in processor development.

OEMs now collaborate directly with semiconductor manufacturers to create processors tailored to their specific needs.

In 2023, Western companies accounted for over 95% of automotive ADAS and infotainment processor revenues. However, they are facing increasing competition from Chinese companies.

“Horizon Robotics and HiSilicon (a subsidiary of Huawei) are making significant strides in the central processor market,” says Yole’s Hugo Antoine, “for example, Horizon Robotics’ automotive revenues increased by 57% between 2022 and 2023. Although this growth is mainly concentrated in the Chinese market, Western companies are investing heavily to establish a presence in China. Currently, Tesla is the only company to have successfully developed its own central processors, but the Chinese car manufacturer Nio has started designing its own, capable of combining the power of four Nvidia Orin processors into a single SoC. ”

In the infotainment sector, Chinese companies such as Rockchip, Unisoc, BlackSesame, SemiDrive, and SiEngine are growing, though their adoption remains limited. The Chinese market is still largely dominated by Qualcomm

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr