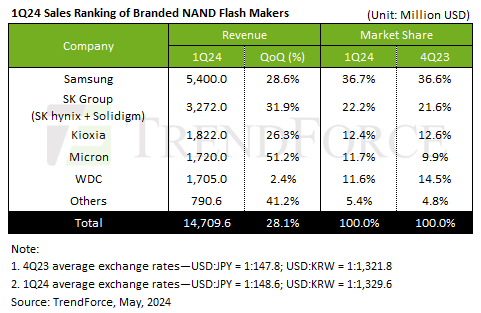

Q1 saw NAND revenues rise by 28.1% to $14.71 billion, says TrendForce.

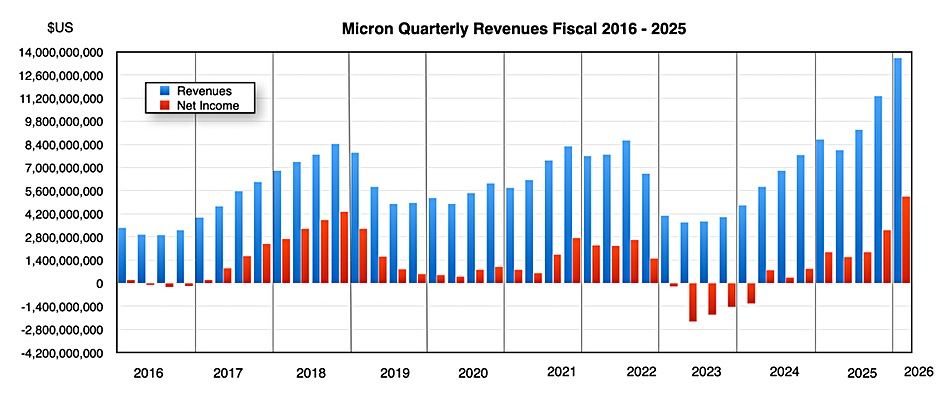

Micron overtook Western Digital to claim the fourth spot with 51.2% QoQ revenue growth to $1.72 billion.

Samsung remained No.1 with a 28.6% QoQ revenue jump to $5.40 billion. It expects 20% growth in Q2.

NAND revenues rising; Q2 prices to grow 10%

Hynix saw a 31.9% QoQ increase in revenue to $3.27 billion in Q1, and also expects a 20% growth in Q2.

Kioxia had a 26.3% QoQ rise in revenue to $1.82 billion and expects to grow Q2 revenue by approximately 20%.

Western Digital had a 2.4% QoQ revenue increase, reaching $1.71 billion and expects Q2 revenue to remain flat.

The surge in large enterprise SSD orders continues to drive up the ASP of NAND Flash by 15%. TrendForce forecasts Q2 NAND revenue to increase by nearly 10% QoQ.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

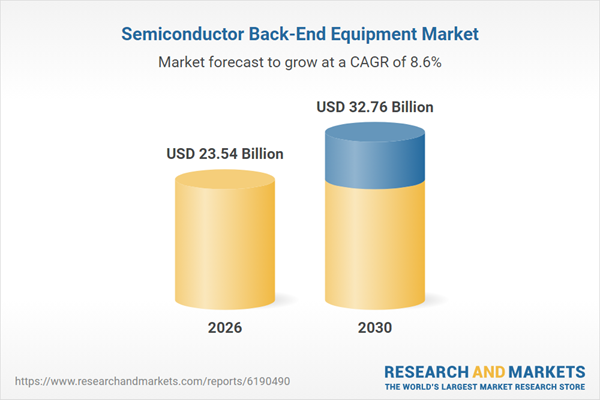

The semiconductor back-end equipment market has shown significant expansion, projected to grow from $21.65 billion in 2025 to $23.54 billion in 2026 at a CAGR of 8.7%. This growth is driven by increas

2026 is shaping up as a breakout year for cloud application-specific integrated circuit (ASIC) shipments. Not only has Broadcom secured mass production projects with multiple major cloud service provi

Semiconductor industry watchers say the memory market has entered a prolonged upcycle, with DRAM and NAND likely to remain in short supply until at least 2028.Historically, memory suppliers have veere