Power module revenue will grow from $8 billion in 2023 to $16 billion by 2029 representing a 12.1% CAGR between 2023 and 2029, according to Yole Group.

The power module packaging costs fully depend on the packaging materials, such as die-attach and ceramic substrate materials, and the package size.

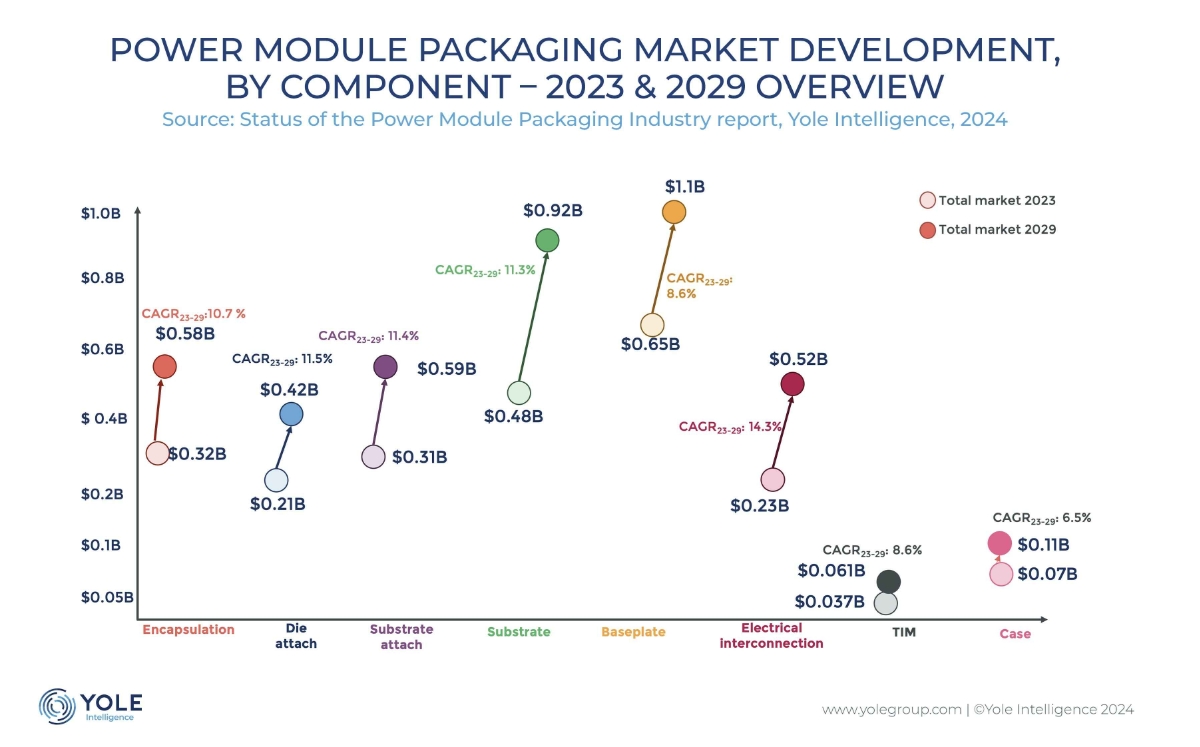

In 2023, it represented a $2.3 billion market in 2023, with the cost of materials for power module packaging representing about 30 % of the total power module cost.

Materials cost will have an 11% CAGR between 2023 and 2029, and the market should reach $4.3 billion by 2029.

The largest power module packaging material segment is the baseplate, which will be worth $1,070 million by 2029, against $651 million in 2023. Its CAGR will be 9% between 2023 and 2029, closely followed by the ceramic substrate market segment.

“Today, continuous improvements in module materials and packaging design are needed to take advantage of the benefits of SiC technology,” says Yole’s Shalu Agarwal, “however , the development is simultaneously focused on reducing the costs of power modules through “good enough” performance and reliability.”

“The power module packaging supply chain is continually being reshaped, with new companies entering power module manufacturing,” adds Agarwalm “these companies are expanding their product portfolios and forming new partnerships and M&As. In this dynamic context, the growth of Asian packaging material players puts intense cost pressure on European players.”

The leading power module suppliers are in Europe and Japan, with Infineon Technologies, Semikron Danfoss, Fuji Electric, and Mitsubishi Electric.

Meanwhile, the leading module packaging material suppliers are primarily located in the US, where Yole Group has identified Rogers Corporation, MacDermid Alpha, 3M, Dow, and Indium Corporation, in Europe with Heraeus, Henkel, for example, and in Japan, with FTH (formally known as Ferrotec), Proterial, Kyocera, Dowa, Denka, Tanaka, Resonac, and NGK Insulators.

The geographic expansion of packaging material providers is increasing. Japanese players have a powerful presence in materials but sometimes need help accessing other regions. Therefore, they are trying to grow their presence in China, Europe, and the United States and are investing in developing their businesses within these regions.

For example, Japan’s NGK Insulators is planning to manufacture ceramic substrates in Poland. Similarly, European and U.S. players, such as Heraeus, Henkel, MacDermid Alpha, and Rogers Corporation, are focusing on Asia, mainly China.

At the same time, several companies along the supply chain have either moved or are planning to transfer their production to countries with a lower cost of production to reduce costs, such as Vietnam, Hungary, Malaysia, and Romania.

This leads to more robust competition, increased price pressure, and increasing motivation for partnerships and M&As.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr