Texas Instruments reported strong first-quarter results, with revenue of US$4.07 billion, surpassing forecasts, driven by a 13% rise in its Analog segment. The upbeat outlook signals sustained demand in automotive and industrial markets despite tariff-related uncertainties. CEO Haviv Ilan emphasized the company's focus on reliable chip capacity amid geopolitical risks.

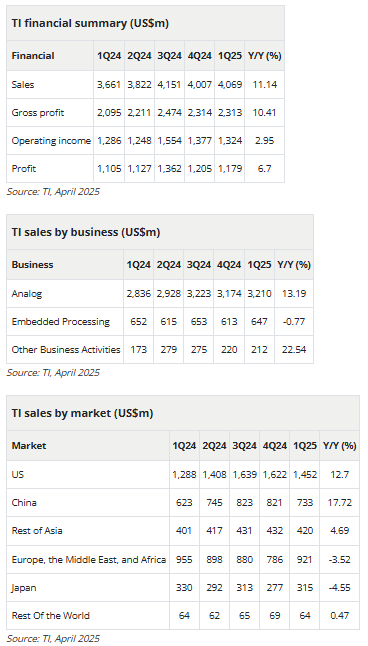

Texas Instruments reported robust financial results for the first quarter of 2025, exceeding analyst expectations and signaling continued strength in demand across its key markets. The company posted revenue of US$4.07 billion, an 11% increase year-over-year and ahead of the consensus estimate of US$3.91 billion. Operating profit rose 3% to US$1.32 billion, comfortably surpassing the projected US$1.18 billion.

Revenue growth was primarily driven by the Analog segment, which generated US$3.21 billion, representing a 13% increase compared to the same period in 2024. The Embedded Processing unit saw a slight decline in revenue, falling 0.8% year-over-year to US$647 million, but still above the forecast of US$617 million. Other revenue streams contributed US$212 million, marking a 23% rise from the previous year.

Looking ahead, Texas Instruments provided guidance for the second quarter that indicates continued growth. The company expects revenue to range between US$4.17 billion and US$4.53 billion, which compares favorably with the Bloomberg consensus estimate of US$4.12 billion.

Industry analysts have responded positively to Texas Instruments' latest results and outlook. Bloomberg Intelligence noted that the company's "decisive beat on first-quarter sales and its second-quarter outlook suggest positive signs of robust demand across automotive and industrial segments." However, the research provider also cautioned that part of the demand could be driven by customers accelerating orders and building inventory in anticipation of rising costs linked to tariffs.

Bloomberg, citing Truist Securities, highlighted that the quarterly results surpassed expectations on key financial metrics, including earnings, revenue, and operating margin. The brokerage firm also emphasized constructive capital allocation strategies that benefit shareholders. According to Truist, the company's outlook for the upcoming quarter remains above consensus forecasts, reinforcing confidence in Texas Instruments' growth prospects.

Similarly, Vital Knowledge described the quarter as demonstrating a "solid upside" in both earnings and sales performance. The firm added that the outlook "was much better than feared," suggesting that concerns regarding potential demand weaknesses or market softness have yet to materialize.

Uncertainties ahead

Amid rising global uncertainty due to tariffs and geopolitical tensions, Texas Instruments CEO Haviv Ilan stressed the semiconductor industry's crucial role and the company's readiness to adapt. He noted that geopolitical disruptions and supply chain volatility are heightening the need for reliable chip capacity globally.

Ilan described the current period as one of heightened unpredictability, driven by disrupted global supply chains, tariff policies, and international relations, which create complex economic conditions. Despite this, the semiconductor sector remains crucial due to the increasing global demand for chips. Ilan emphasized the importance of robust capacity and inventory, stating that history supports the need for these in uncertain times. He highlighted TI's focus on ensuring "geopolitically dependable capacity," a key value driver for its customers.

Cyclical recovery ahead

Ilan expressed cautious optimism for the second quarter, stating that TI anticipates no immediate negative impacts despite ongoing uncertainties. The company is working closely with customers to adapt to changing needs and prepare for various scenarios through the end of 2025 and into 2026. "We remain flexible to navigate evolving supply-chain dynamics," he noted.

Ilan explained that Texas Instruments' sales growth in the second quarter was largely due to the cyclical recovery of key markets rather than tariff-related ordering. Sectors such as personal electronics, enterprise, communications, and particularly industrial markets are experiencing year-over-year growth. He noted that the industrial sector is catching up, with customers rebuilding stock due to low inventory levels, marking a true recovery rather than a preemptive stockpiling in response to tariff issues.

Ilan highlighted that the expected 7% growth for the second quarter, at the high end of typical trends, is driven by strong industrial demand, a pattern evident since late 2024. Other sectors, like automotive, are also showing steady progress. He emphasized that the robust industrial performance indicates a broader upturn, aligning with long-term growth trends in semiconductor demand.

China still key for TI despite uncertainties

Ilan noted that the company earns about 19% to 20% of its revenue from customers based in China and acknowledged the challenges of retaliatory tariffs. However, he stressed the value of long-term relationships with Chinese clients and TI's competitive edge in product range, quality, scale, and service. To counter supply risks and offer swift service, the company strategically positions inventory near customers' manufacturing sites, including consigned stock. This setup is part of TI's strategy to ensure reliable capacity amid changing trade dynamics.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr