Industry association SEMI said semiconductor manufacturers will spend $400 billion on computer chip-making equipment in 2025-2027.

Spending on 300mm fab equipment is being driven by regionalization of semiconductor fabs and the increasing demand for artificial intelligence (AI) chips used in data centers and edge devices, SEMI report indicated.

Key equipment vendors include ASML, Applied Materials, KLA and Lam Research, and Tokyo Electron.

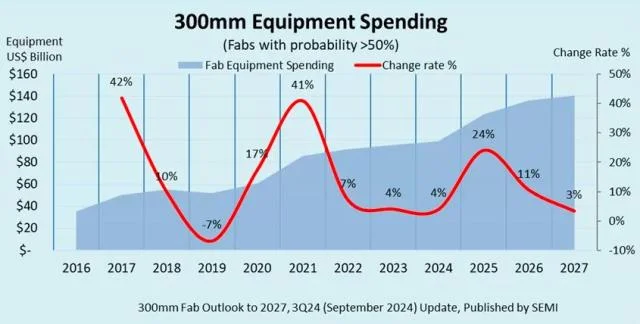

In 2024, spending on 300mm fab equipment is projected to grow by 4 percent to $99.3 billion.

In 2025, spending on 300mm fab equipment is projected to increase by 24 percent to $123.2 billion.

In 2026, spending on 300mm fab equipment is forecast to achieve 11 percent growth to $136.2 billion.

In 2027, spending on 300mm fab equipment is projected to grow by 3 percent to $140.8 billion.

“The world’s need for chips is boosting spending on equipment for both leading-edge technologies addressing AI applications and mature technologies driven by automotive and IoT applications,” Ajit Manocha, SEMI President and CEO, said.

China is projected to invest over $100 billion on 300mm equipment in the next three years driven by its national self-sufficiency policies. China’s spending on 300mm equipment is anticipated to decrease from a peak of $45 billion in 2024 to $31 billion by 2027.

South Korea, home to memory chip makers Samsung and SK Hynix, is estimated to invest $81 billion on 300mm equipment in three years to enhance its dominance in memory segments including DRAM, high-bandwidth memory (HBM), and 3D NAND Flash.

Taiwan, home to top contract chipmaker TSMC, is forecast to spend $75 billion on 300mm equipment over the next three years as the region’s chipmakers build some new fabs overseas.

Americas is projected to invest $63 billion on 300mm equipment from 2025 to 2027.

Japan, Europe & Mideast, and SE Asia are expected to spend $32 billion, $27 billion, and $13 billion, respectively, on 300mm equipment.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr