According to TrendForce’s latest memory spot price trend report, neither did the DRAM nor NAND spot prices sees much momentum last week. Spot prices of DDR4 and DDR5 products didn’t show significant fluctuations as the market has not seen a demand uptick. As for NAND flash, the wave of stocking demand during July in response with the peak season in the third quarter of each year didn’t appear. Details are as follows:

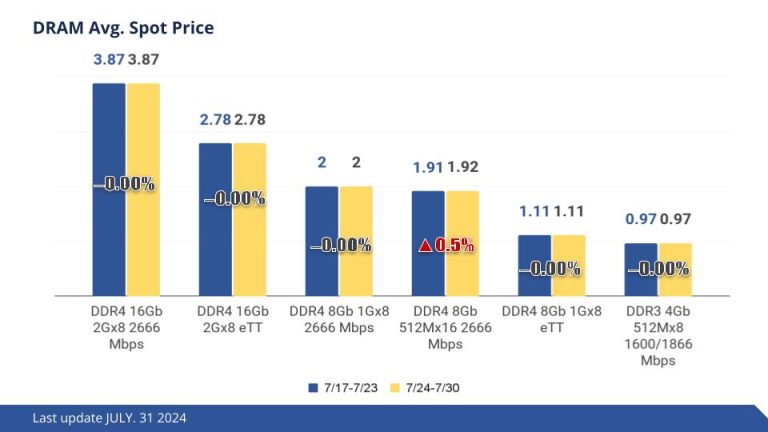

DRAM Spot Price:

In the spot market, the overall trading volume has fallen further because the demand for consumer electronics has yet to rebound, and Taiwan’s spot trading was suspended for two days (from July 24th to 25th) due to a typhoon. The spot market as a whole has not seen a demand uptick compared to the previous week, and buyers are mostly waiting for further developments. Consequently, spot prices of DDR4 and DDR5 products have not shown significant fluctuations. The average spot price of the mainstream chips (i.e., DDR4 1Gx8 2666MT/s) dropped by 0.35% from US$2 last week to US$1.993 this week.

NAND Flash Spot Price:

The spot market would usually generate a wave of stocking demand during July in response with the peak season in the third quarter of each year, but has been rather sluggish this year due to the sufficient extent of inventory among end clients, as well as enervated market demand. A small number of spot traders were attempting to lower their quotations tentatively last week in the hope of revitalizing buyers’ demand, which was proven to be quite ineffective. Generally speaking, recent spot market prices have been somewhat lethargic alongside a continuous shrinkage of transactions. Spot price of 512Gb TLC wafers remains unchanged this week at US$3.253.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung is reportedly evaluating a potential European semiconductor expansion alongside its South Korea and US manufacturing base, as the region tightens local production requirements and Germany seek

Given frequent price increases across precious metals, wafer foundry services, and packaging and testing, Infineon's announcement of price increases is very telling for the market. The company wil

Nvidia has recently signaled to Samsung Electronics that it hopes to secure early deliveries of sixth-generation high-bandwidth memory, known as HBM4. At the same time, as memory makers devote an incr